Buy Now, Pay Later: Understanding The New Consumer Protection Measures

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: Understanding the New Consumer Protection Measures

The rise of "Buy Now, Pay Later" (BNPL) services has revolutionized online shopping, offering consumers a tempting alternative to traditional credit cards. But with this convenience comes risk, leading to increased scrutiny and the implementation of significant new consumer protection measures. This article will delve into the latest regulations designed to safeguard consumers from the potential pitfalls of BNPL schemes.

The Explosive Growth of BNPL and its Associated Risks

BNPL services, offered by companies like Klarna, Afterpay (now a part of Square), and Affirm, have experienced explosive growth in recent years. Their appeal is undeniable: the ability to purchase goods and services immediately and pay in installments, often interest-free, is incredibly attractive, particularly to younger generations and those with limited access to traditional credit.

However, this ease of access also presents considerable risks. Consumers can easily overspend, accumulating multiple BNPL debts that become difficult to manage. Late payment fees can quickly escalate, and missed payments can negatively impact credit scores, despite the fact that some BNPL providers don't always report to credit bureaus. The lack of transparency surrounding fees and interest can also lead to unexpected costs.

New Consumer Protection Measures: A Much-Needed Response

Recognizing these risks, governments worldwide are introducing stringent regulations to protect consumers. These measures vary by country but generally focus on several key areas:

-

Increased Transparency: Regulations are mandating greater transparency in BNPL agreements, requiring clear disclosure of all fees, interest rates, and repayment terms upfront. This helps consumers make informed decisions before committing to a purchase.

-

Credit Reporting: Many jurisdictions are pushing for BNPL providers to report payment history to credit bureaus. This allows lenders to assess a consumer's creditworthiness more accurately and helps prevent over-indebtedness. This move aims to bring BNPL more in line with traditional credit products concerning credit reporting and risk assessment.

-

Debt Management Tools: Some regulations are requiring BNPL providers to offer better debt management tools and resources to consumers struggling with repayments, including options for debt consolidation or repayment plans.

-

Affordability Checks: Several countries are exploring measures to ensure that consumers can afford the repayments before they are approved for a BNPL loan. This might involve stricter affordability checks similar to those used for traditional credit applications.

-

Limits on Spending: Some jurisdictions are considering placing limits on the total amount consumers can borrow using BNPL services within a given timeframe to prevent excessive borrowing.

Navigating the BNPL Landscape Responsibly

While these new regulations are a significant step forward, consumers still need to exercise caution when using BNPL services. Here are some tips for responsible BNPL use:

- Budget Carefully: Only use BNPL for purchases you can comfortably afford to repay within the agreed timeframe.

- Read the Fine Print: Thoroughly review the terms and conditions before agreeing to a BNPL agreement. Pay close attention to fees, interest rates, and repayment schedules.

- Track Your Spending: Keep track of all your BNPL purchases and repayments to avoid accumulating excessive debt.

- Explore Alternatives: Consider alternative financing options if you're struggling to manage your BNPL repayments. Consult a financial advisor if needed.

The Future of BNPL Regulation

The regulatory landscape surrounding BNPL is constantly evolving. As the industry continues to grow, we can expect further regulations aimed at enhancing consumer protection and promoting responsible lending practices. Staying informed about these changes is crucial for both consumers and businesses operating within the BNPL sector. By understanding the new regulations and practicing responsible borrowing habits, consumers can harness the convenience of BNPL while mitigating the associated risks.

Call to Action: Share this article with friends and family to help spread awareness about the new consumer protection measures for Buy Now, Pay Later services. Understanding these changes is key to responsible financial management in the digital age.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: Understanding The New Consumer Protection Measures. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

May 17 Mlb Home Run Predictions Smart Picks And Best Odds For Saturdays Games

May 20, 2025

May 17 Mlb Home Run Predictions Smart Picks And Best Odds For Saturdays Games

May 20, 2025 -

Slowdown Ahead U S Treasury Yields Fall On Feds Rate Cut Outlook

May 20, 2025

Slowdown Ahead U S Treasury Yields Fall On Feds Rate Cut Outlook

May 20, 2025 -

Ufc Fans React To Jon Jones Cryptic I M Done Tweet Aspinall Fight In Jeopardy

May 20, 2025

Ufc Fans React To Jon Jones Cryptic I M Done Tweet Aspinall Fight In Jeopardy

May 20, 2025 -

International Support Urged For Balis Tourist Safety Initiatives

May 20, 2025

International Support Urged For Balis Tourist Safety Initiatives

May 20, 2025 -

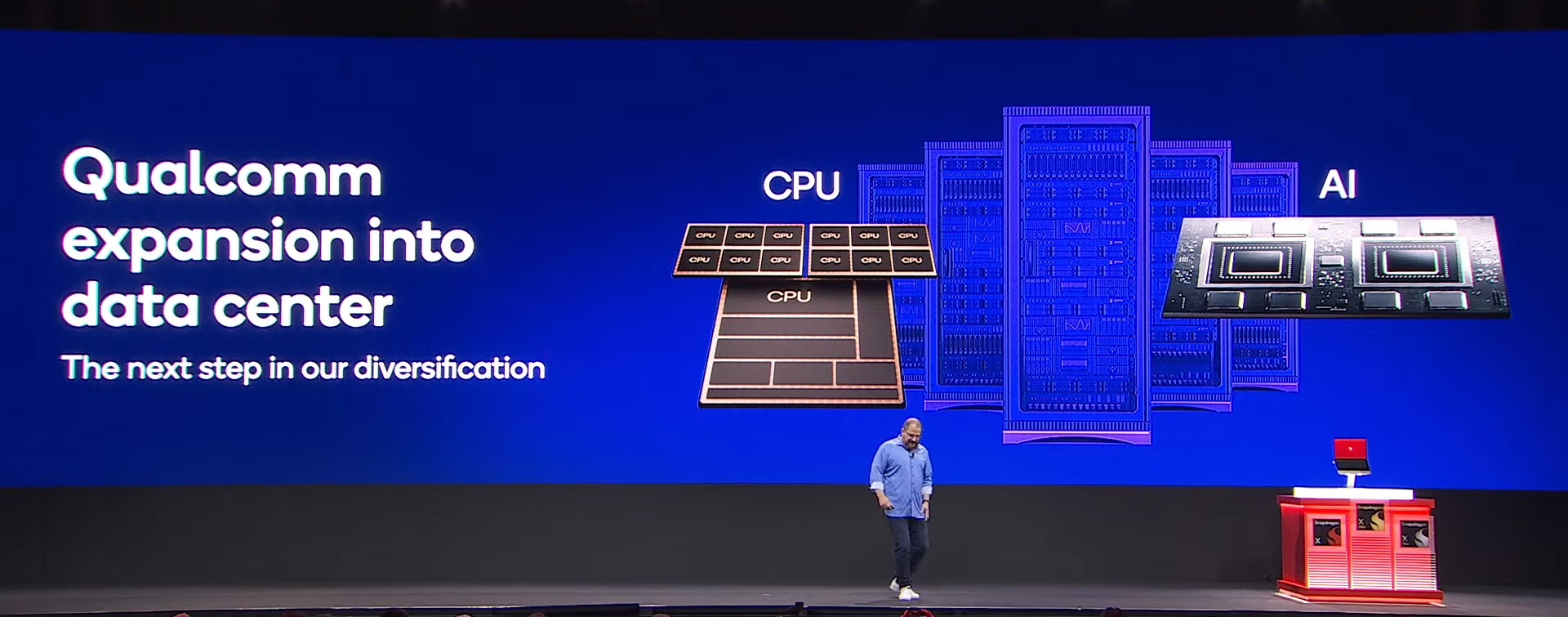

Qualcomms Next Gen Data Center Cpus And Ai Accelerators What To Expect

May 20, 2025

Qualcomms Next Gen Data Center Cpus And Ai Accelerators What To Expect

May 20, 2025

Latest Posts

-

Record Bitcoin Etf Investments 5 Billion And Growing

May 21, 2025

Record Bitcoin Etf Investments 5 Billion And Growing

May 21, 2025 -

Increased Consumer Protections Understanding The Updated Buy Now Pay Later Regulations

May 21, 2025

Increased Consumer Protections Understanding The Updated Buy Now Pay Later Regulations

May 21, 2025 -

Heartbreak And Humanity Why The Last Of Us Still Resonates

May 21, 2025

Heartbreak And Humanity Why The Last Of Us Still Resonates

May 21, 2025 -

Jon Jones Retirement Rumors Intensify Aspinall Fight Delays Add Fuel To The Fire

May 21, 2025

Jon Jones Retirement Rumors Intensify Aspinall Fight Delays Add Fuel To The Fire

May 21, 2025 -

Us Factory Highlights Contradictions In Trumps Trade Approach

May 21, 2025

Us Factory Highlights Contradictions In Trumps Trade Approach

May 21, 2025