Facing A Car Finance Judgement: Understanding Your Options

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Facing a Car Finance Judgement: Understanding Your Options

Facing a car finance judgement can feel overwhelming, but understanding your options is the first step towards resolving the situation. A judgement against you means the court has ruled in favor of the lender, often resulting in wage garnishment, bank account levies, or even property seizure. This article will guide you through navigating this difficult situation, outlining your options and helping you regain financial control.

What Happens After a Car Finance Judgement?

A car finance judgement typically allows the lender to pursue various methods to recover the outstanding debt. These can include:

- Wage Garnishment: A portion of your wages will be automatically deducted and sent to the lender until the debt is paid. The amount garnished is legally limited, but it can still significantly impact your finances.

- Bank Account Levy: The lender can seize funds directly from your bank account. This can leave you with insufficient funds for essential expenses.

- Property Seizure: In extreme cases, the lender may seize other assets to recover the debt, although this is less common with car finance judgements unless the debt is exceptionally large.

- Damage to Credit Score: A car finance judgement will severely damage your credit score, making it harder to obtain loans, credit cards, or even rent an apartment in the future.

Understanding Your Options After Judgement

While a car finance judgement seems daunting, several options exist to manage the situation:

1. Negotiate with the Lender: This is often the best first step. Contact the lender directly and explain your financial situation. They may be willing to negotiate a payment plan or settlement that is more manageable. Be prepared to provide documentation of your income and expenses.

2. Seek Legal Counsel: A lawyer specializing in debt collection can advise you on your rights and explore legal options such as appealing the judgement (if grounds exist) or negotiating a settlement. They can help you navigate the complexities of the legal system and protect your interests.

3. Explore Debt Consolidation or Management Programs: If you have multiple debts, consolidating them into a single loan with a lower interest rate can simplify payments. Debt management programs can help you create a budget and negotiate with creditors. However, be aware of the fees and terms associated with these programs. Consider seeking advice from a reputable non-profit credit counseling agency.

4. Consider Bankruptcy (as a last resort): Bankruptcy should be considered only as a last resort, as it has significant long-term consequences. It can eliminate certain debts, including car finance judgements, but it will also severely impact your credit score. It's crucial to consult with a bankruptcy attorney before making this decision.

Preventing Future Judgement Issues:

- Budget Carefully: Create a realistic budget and stick to it. This helps avoid falling behind on payments.

- Maintain Open Communication with Lenders: Contact your lender immediately if you anticipate difficulties making payments. Early communication can often lead to more favorable outcomes.

- Understand Your Loan Agreement: Thoroughly read and understand the terms of your car loan agreement before signing.

Conclusion:

Facing a car finance judgement is a serious matter, but it doesn't have to be the end of the world. By understanding your options and taking proactive steps, you can work towards resolving the debt and rebuilding your financial stability. Remember to seek professional help from a lawyer or financial advisor if you need assistance navigating this challenging situation. Don't hesitate to reach out for help – there are resources available to guide you through this process.

Keywords: Car finance judgement, car loan judgement, debt judgement, wage garnishment, bank levy, credit score, debt negotiation, bankruptcy, legal advice, financial advice, debt management, debt consolidation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Facing A Car Finance Judgement: Understanding Your Options. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stock Market Slumps As Trump Fires Bls Commissioner Intensifying Tariff Fallout

Aug 04, 2025

Stock Market Slumps As Trump Fires Bls Commissioner Intensifying Tariff Fallout

Aug 04, 2025 -

Nuclear Submarines Redeployed Trumps Reaction To Russias Aggressive Rhetoric

Aug 04, 2025

Nuclear Submarines Redeployed Trumps Reaction To Russias Aggressive Rhetoric

Aug 04, 2025 -

Facing A Car Finance Judgement Understanding Your Options

Aug 04, 2025

Facing A Car Finance Judgement Understanding Your Options

Aug 04, 2025 -

Trump Responds To Russia Nuclear Submarines Repositioned Following Threat

Aug 04, 2025

Trump Responds To Russia Nuclear Submarines Repositioned Following Threat

Aug 04, 2025 -

Economic Turmoil Trumps Firing Of Bls Head Follows Tariff Related Stock Market Crash

Aug 04, 2025

Economic Turmoil Trumps Firing Of Bls Head Follows Tariff Related Stock Market Crash

Aug 04, 2025

Latest Posts

-

Stock Market Slumps As Trump Fires Bls Commissioner Intensifying Tariff Fallout

Aug 04, 2025

Stock Market Slumps As Trump Fires Bls Commissioner Intensifying Tariff Fallout

Aug 04, 2025 -

Economic Turmoil Trumps Firing Of Bls Head Follows Tariff Related Stock Market Crash

Aug 04, 2025

Economic Turmoil Trumps Firing Of Bls Head Follows Tariff Related Stock Market Crash

Aug 04, 2025 -

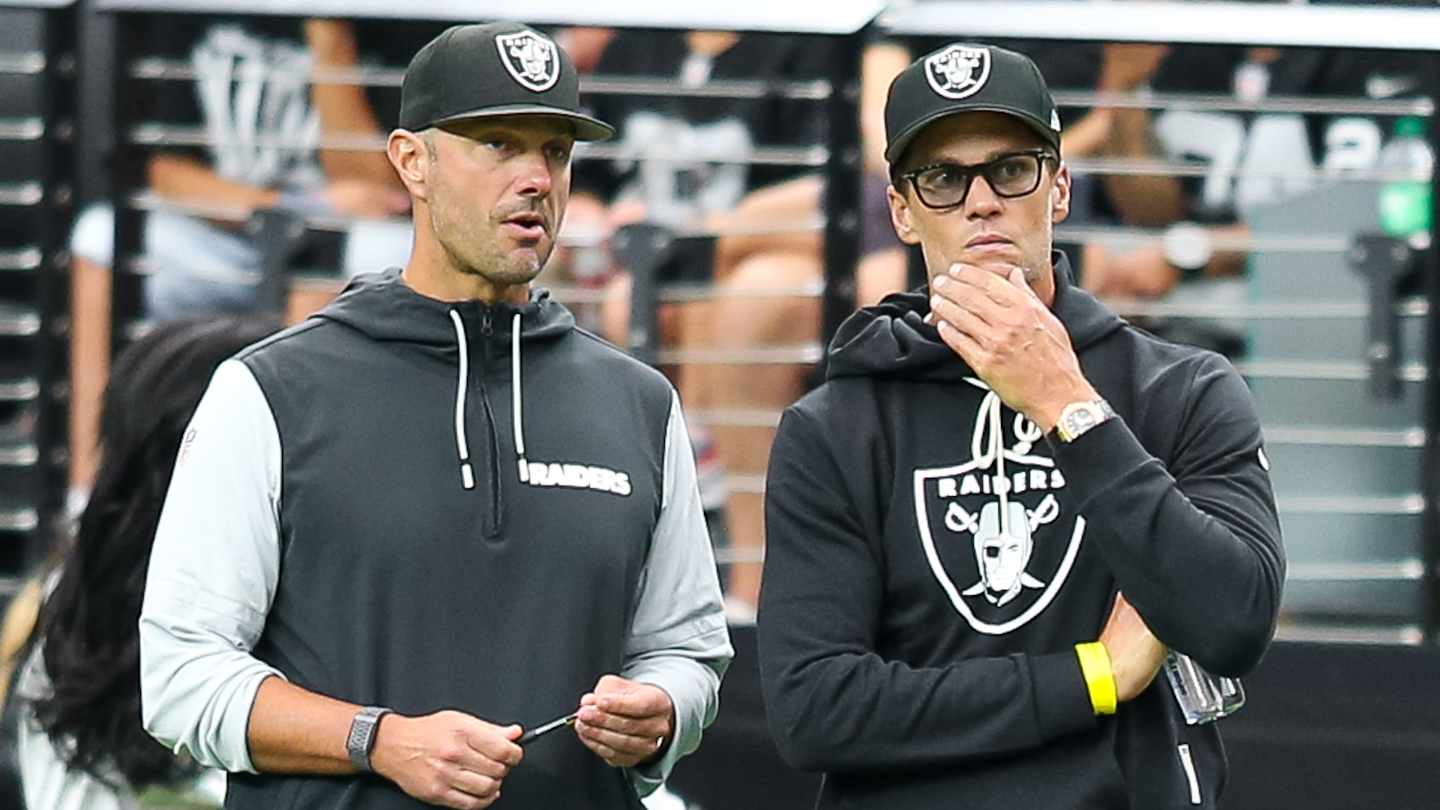

Post Scrimmage Analysis Evaluating The Las Vegas Raiders Performance

Aug 04, 2025

Post Scrimmage Analysis Evaluating The Las Vegas Raiders Performance

Aug 04, 2025 -

Trump Responds To Russia Nuclear Submarines Repositioned Following Threat

Aug 04, 2025

Trump Responds To Russia Nuclear Submarines Repositioned Following Threat

Aug 04, 2025 -

White House Shakeup Trump Removes Bls Head After Tariff Induced Market Decline

Aug 04, 2025

White House Shakeup Trump Removes Bls Head After Tariff Induced Market Decline

Aug 04, 2025