Stock Market Slumps As Trump Fires BLS Commissioner, Intensifying Tariff Fallout

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Slumps as Trump Fires BLS Commissioner, Intensifying Tariff Fallout

The US stock market experienced a significant downturn today, following the controversial firing of Bureau of Labor Statistics (BLS) Commissioner, William Zeile, and escalating concerns over the ongoing trade war. The dual shocks sent ripples through Wall Street, leaving investors questioning the stability of the American economy and the administration's economic policies.

Trump's Controversial Dismissal Shakes Confidence

President Trump's abrupt dismissal of Commissioner Zeile, a respected figure known for his commitment to data integrity and non-partisan analysis, ignited immediate criticism from across the political spectrum. The official White House statement cited "philosophical differences" as the reason for the termination, but many suspect the move was retaliatory, stemming from the BLS's recent reports showing slower-than-expected job growth and a rise in unemployment claims. This lack of transparency fueled concerns about political interference in vital economic data collection, a cornerstone of market stability. Experts fear this action could undermine the credibility of the BLS and erode investor confidence in the reliability of official economic indicators.

Tariff Fallout Deepens Economic Uncertainty

The market slump is further exacerbated by the intensifying fallout from the administration's ongoing trade disputes, particularly with China. The recent escalation of tariffs has already begun to impact various sectors, leading to increased costs for consumers and businesses. This uncertainty, coupled with the BLS commissioner's dismissal, has created a perfect storm of negative sentiment, triggering a sell-off across major indices. The Dow Jones Industrial Average fell sharply, mirroring similar declines in the S&P 500 and Nasdaq.

What This Means for Investors

The current situation presents significant challenges for investors. The unpredictable nature of the administration's economic policies, coupled with the trade war's escalating consequences, creates a volatile and uncertain market environment. Many analysts predict further market volatility in the short term.

Experts weigh in:

-

Dr. Anya Sharma, Chief Economist at Global Investment Strategies: "The firing of Commissioner Zeile is incredibly damaging. It casts a shadow of doubt over the integrity of US economic data, which is crucial for informed investment decisions. Combined with the tariff situation, this creates a perfect storm of uncertainty, likely leading to continued market instability."

-

Mark Johnson, Senior Portfolio Manager at Capital Advisors: "Investors are understandably nervous. The lack of transparency surrounding the commissioner's dismissal, coupled with the ongoing trade war, is creating a significant risk-off environment. We advise investors to carefully review their portfolios and consider diversifying their holdings."

Moving Forward:

The coming days and weeks will be crucial in determining the market's trajectory. The administration's response to the criticism surrounding the dismissal, as well as any further developments in the trade negotiations, will significantly impact investor sentiment and market performance. It remains to be seen whether the administration will address these concerns and take steps to restore confidence in the US economy. For now, the market reflects a significant level of apprehension.

Keywords: Stock Market, Stock Market Crash, Stock Market Slump, Trump, BLS, Bureau of Labor Statistics, Tariffs, Trade War, Economic Uncertainty, William Zeile, Market Volatility, Investment, Dow Jones, S&P 500, Nasdaq, Economic Indicators.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Slumps As Trump Fires BLS Commissioner, Intensifying Tariff Fallout. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Facing A Car Finance Judgement Understanding Your Options

Aug 04, 2025

Facing A Car Finance Judgement Understanding Your Options

Aug 04, 2025 -

Stock Market Slumps As Trump Fires Bls Commissioner Intensifying Tariff Fallout

Aug 04, 2025

Stock Market Slumps As Trump Fires Bls Commissioner Intensifying Tariff Fallout

Aug 04, 2025 -

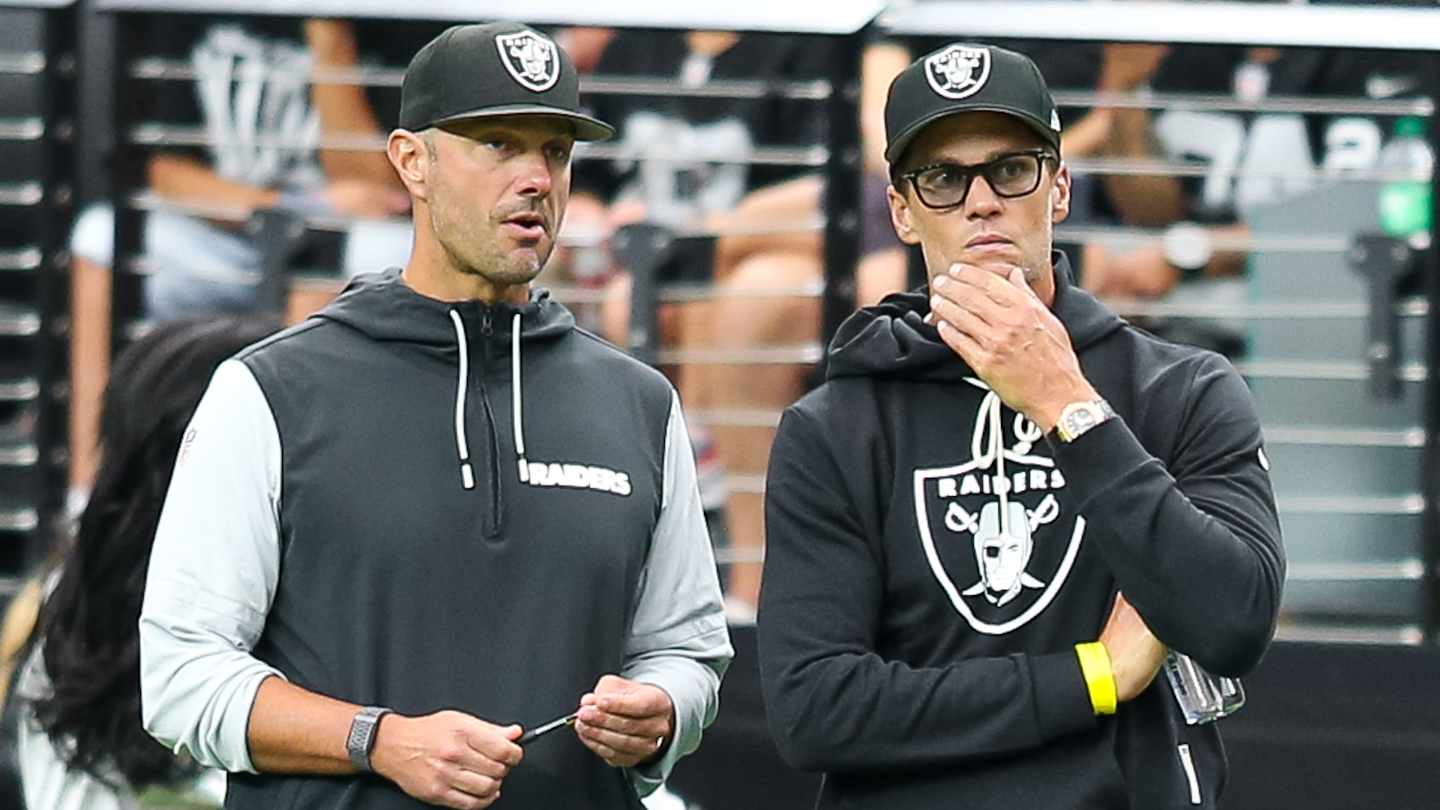

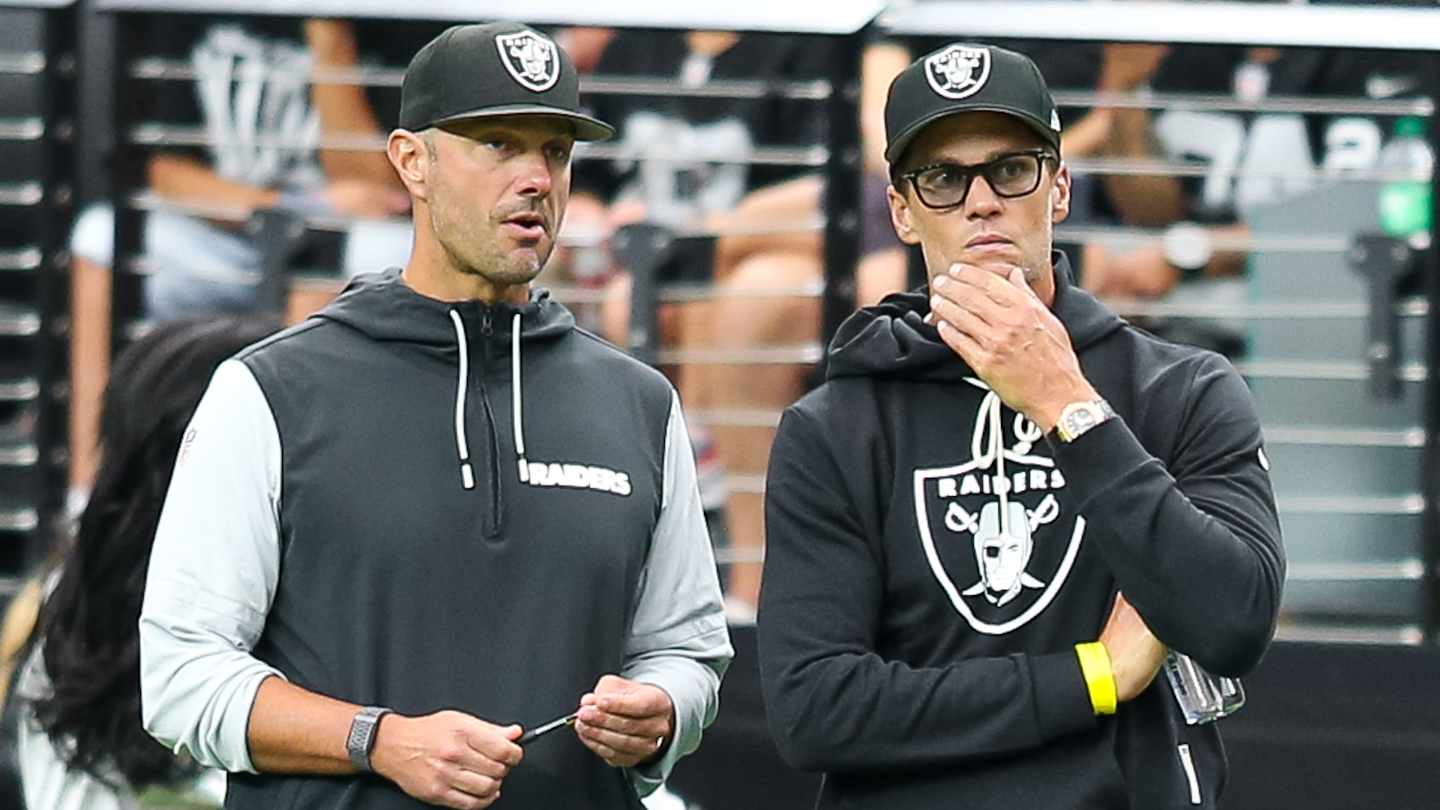

Post Scrimmage Analysis Evaluating The Las Vegas Raiders Performance

Aug 04, 2025

Post Scrimmage Analysis Evaluating The Las Vegas Raiders Performance

Aug 04, 2025 -

Trump Responds To Russia Nuclear Submarines Repositioned Following Threat

Aug 04, 2025

Trump Responds To Russia Nuclear Submarines Repositioned Following Threat

Aug 04, 2025 -

White House Shakeup Trump Removes Bls Head After Tariff Induced Market Decline

Aug 04, 2025

White House Shakeup Trump Removes Bls Head After Tariff Induced Market Decline

Aug 04, 2025

Latest Posts

-

Stock Market Slumps As Trump Fires Bls Commissioner Intensifying Tariff Fallout

Aug 04, 2025

Stock Market Slumps As Trump Fires Bls Commissioner Intensifying Tariff Fallout

Aug 04, 2025 -

Economic Turmoil Trumps Firing Of Bls Head Follows Tariff Related Stock Market Crash

Aug 04, 2025

Economic Turmoil Trumps Firing Of Bls Head Follows Tariff Related Stock Market Crash

Aug 04, 2025 -

Post Scrimmage Analysis Evaluating The Las Vegas Raiders Performance

Aug 04, 2025

Post Scrimmage Analysis Evaluating The Las Vegas Raiders Performance

Aug 04, 2025 -

Trump Responds To Russia Nuclear Submarines Repositioned Following Threat

Aug 04, 2025

Trump Responds To Russia Nuclear Submarines Repositioned Following Threat

Aug 04, 2025 -

White House Shakeup Trump Removes Bls Head After Tariff Induced Market Decline

Aug 04, 2025

White House Shakeup Trump Removes Bls Head After Tariff Induced Market Decline

Aug 04, 2025