Fed Signals Single Rate Cut In 2025: US Treasury Yields Dip

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Signals Single Rate Cut in 2025: US Treasury Yields Dip

The Federal Reserve's (Fed) latest projections sent ripples through the financial markets, signaling a single interest rate cut in 2025. This announcement, following a widely anticipated pause in its aggressive rate-hiking campaign, led to a noticeable dip in US Treasury yields. The move suggests a cautious optimism amongst policymakers regarding the future trajectory of inflation and economic growth, though uncertainty remains.

A Shift in Monetary Policy Expectations

The Fed's projections, released following its June meeting, indicated a median expectation of a single 25 basis point rate cut in the fourth quarter of 2025. This marks a significant shift from previous forecasts, which had anticipated holding interest rates steady throughout the year. The change reflects the central bank's assessment of easing inflationary pressures and a potentially slowing economy. While inflation remains above the Fed's 2% target, the recent decline in key indicators like the Consumer Price Index (CPI) has contributed to this more dovish outlook.

Impact on US Treasury Yields

The news immediately impacted US Treasury yields, causing a notable decline. Longer-term yields, particularly those on 10-year and 30-year Treasuries, experienced the most significant drop. This reflects investor sentiment shifting towards a lower-rate environment in the near future. The decrease in yields indicates increased demand for these relatively safe assets, as investors anticipate lower returns from riskier investments. This dynamic highlights the interconnectedness of monetary policy decisions and the bond market.

What Does This Mean for Investors?

This shift in the Fed's stance provides crucial information for investors navigating current market conditions. While a single rate cut in 2025 might seem far off, the change in expectations impacts investment strategies across various asset classes. For example, investors may reassess their holdings in fixed-income securities, considering the potential for lower yields in the future. Similarly, the expectation of a less aggressive monetary policy could influence decisions related to equities and other riskier assets.

Analyzing the Uncertainties

It's important to note that the Fed's projections are not guarantees. Economic conditions remain fluid, and unforeseen events could easily alter the central bank's course. Factors such as persistent inflation, unexpected economic shocks, or geopolitical instability could all influence future interest rate decisions. Therefore, while the single rate cut projection provides a roadmap, it's crucial to remain vigilant and adapt investment strategies based on evolving economic data.

Looking Ahead: The Importance of Data-Driven Decisions

The Fed’s emphasis on data-driven decision-making underscores the importance of closely monitoring key economic indicators. Future inflation reports, employment figures, and other macroeconomic data will be crucial in confirming or challenging the current trajectory. Investors and analysts alike should remain focused on these developments, as they will likely inform the Fed's subsequent actions and ultimately shape the market landscape.

In conclusion, the Fed's signal of a single rate cut in 2025 has significantly influenced market expectations, leading to a dip in US Treasury yields. While this move indicates a cautious optimism regarding the economy, uncertainty remains, highlighting the need for investors to maintain a flexible and data-driven approach to their investment strategies. Keeping a close eye on forthcoming economic data will be vital in understanding the evolving market dynamics and their impact on investments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Signals Single Rate Cut In 2025: US Treasury Yields Dip. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Best Mlb Prop Bets Today Corner Painting Strategies And Player Analysis

May 20, 2025

Best Mlb Prop Bets Today Corner Painting Strategies And Player Analysis

May 20, 2025 -

Todays Mlb Picks See Greg Petersons Expert Baseball Predictions For May 18

May 20, 2025

Todays Mlb Picks See Greg Petersons Expert Baseball Predictions For May 18

May 20, 2025 -

Days After St Louis Tornado Residents Begin Cleanup And Rebuild

May 20, 2025

Days After St Louis Tornado Residents Begin Cleanup And Rebuild

May 20, 2025 -

Jon Jones And Tom Aspinall Analyzing The Strip The Duck Backlash And Its Implications

May 20, 2025

Jon Jones And Tom Aspinall Analyzing The Strip The Duck Backlash And Its Implications

May 20, 2025 -

Local Election Results Dutertes Win And The International Courts Shadow

May 20, 2025

Local Election Results Dutertes Win And The International Courts Shadow

May 20, 2025

Latest Posts

-

New Buy Now Pay Later Regulations What Shoppers Need To Know

May 21, 2025

New Buy Now Pay Later Regulations What Shoppers Need To Know

May 21, 2025 -

Helldivers 2 Warbond Event Master Of Ceremony Skins Drop May 15th

May 21, 2025

Helldivers 2 Warbond Event Master Of Ceremony Skins Drop May 15th

May 21, 2025 -

The Putin Trump Dynamic A Power Shift And Its Global Implications

May 21, 2025

The Putin Trump Dynamic A Power Shift And Its Global Implications

May 21, 2025 -

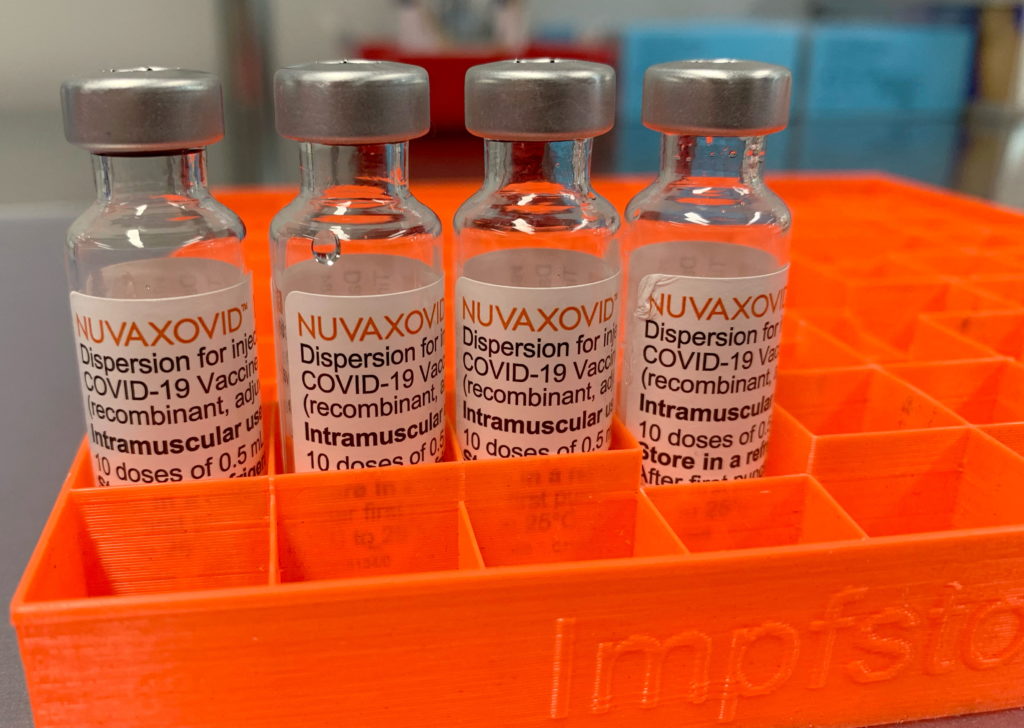

Novavax Covid 19 Vaccine Gets Fda Approval Understanding The Usage Restrictions

May 21, 2025

Novavax Covid 19 Vaccine Gets Fda Approval Understanding The Usage Restrictions

May 21, 2025 -

What Is Femicide Exploring The Causes Behind The Global Surge

May 21, 2025

What Is Femicide Exploring The Causes Behind The Global Surge

May 21, 2025