Fed Under Fire: Billionaire CEO's Warning After Voting For Trump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Under Fire: Billionaire CEO's Warning After Voting for Trump Sparks Outrage

The Federal Reserve is facing intense scrutiny following a controversial statement from a prominent billionaire CEO who publicly admitted to voting for Donald Trump. His subsequent warning about potential economic fallout has ignited a firestorm of debate, raising questions about the Fed's independence and its role in navigating turbulent political waters.

The CEO, [Insert CEO's Name and Company Here – replace with actual name and company], made headlines last week when he revealed his support for the former president in an interview with [Insert Publication Name Here]. While his political leanings are not inherently newsworthy, his subsequent comments about the Federal Reserve's monetary policy sparked a national conversation. He warned of [Summarize the CEO's specific warning – e.g., "potentially devastating inflation" or "a looming recession brought on by misguided Fed policies"].

This statement immediately drew criticism from various sectors. Many argue that his comments represent an undue influence of partisan politics on the crucial work of the central bank, threatening the Fed's hard-earned reputation for political neutrality. Economists across the spectrum are weighing in, with some echoing the CEO's concerns while others sharply rebuke his analysis.

<h3>The Central Bank's Tightrope Walk</h3>

The Federal Reserve's mandate is complex: maintaining price stability and maximum employment. This often involves navigating a delicate balance, particularly during periods of economic uncertainty. The current inflationary environment has forced the Fed to take aggressive measures, including raising interest rates. These measures, while intended to curb inflation, can also slow economic growth, potentially leading to a recession.

This precarious situation makes the Fed a frequent target of criticism, regardless of its actions. Raising interest rates too aggressively risks triggering a recession, while failing to act decisively enough risks fueling inflation. The CEO's comments highlight this inherent tension and underscore the challenges facing the central bank.

<h3>Concerns about Political Influence on the Fed</h3>

The incident raises concerns about the potential influence of wealthy individuals and their political affiliations on monetary policy. Critics argue that such public statements, particularly from individuals with significant economic power, can undermine public trust in the Fed's independence. The debate highlights the need for increased transparency and stricter regulations to prevent undue political influence on the central bank's decision-making process.

<h3>What Happens Next?</h3>

The fallout from the CEO's statement is far from over. Expect further analysis from economists and political commentators, along with potential calls for increased regulatory oversight of the Federal Reserve. The incident serves as a stark reminder of the complex interplay between politics, economics, and the crucial role of the central bank in maintaining a stable financial system. The long-term impact of this controversy remains to be seen, but it undoubtedly raises important questions about accountability and the delicate balance between political influence and economic policy.

Keywords: Federal Reserve, Fed, Monetary Policy, Inflation, Recession, Billionaire CEO, Donald Trump, Economic Policy, Political Influence, Central Bank Independence, Interest Rates

Related Articles: (Link to other relevant articles on your site about the Fed, inflation, etc.)

Call to Action: What are your thoughts on the CEO's statement and its implications for the Fed? Share your opinion in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Under Fire: Billionaire CEO's Warning After Voting For Trump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025 -

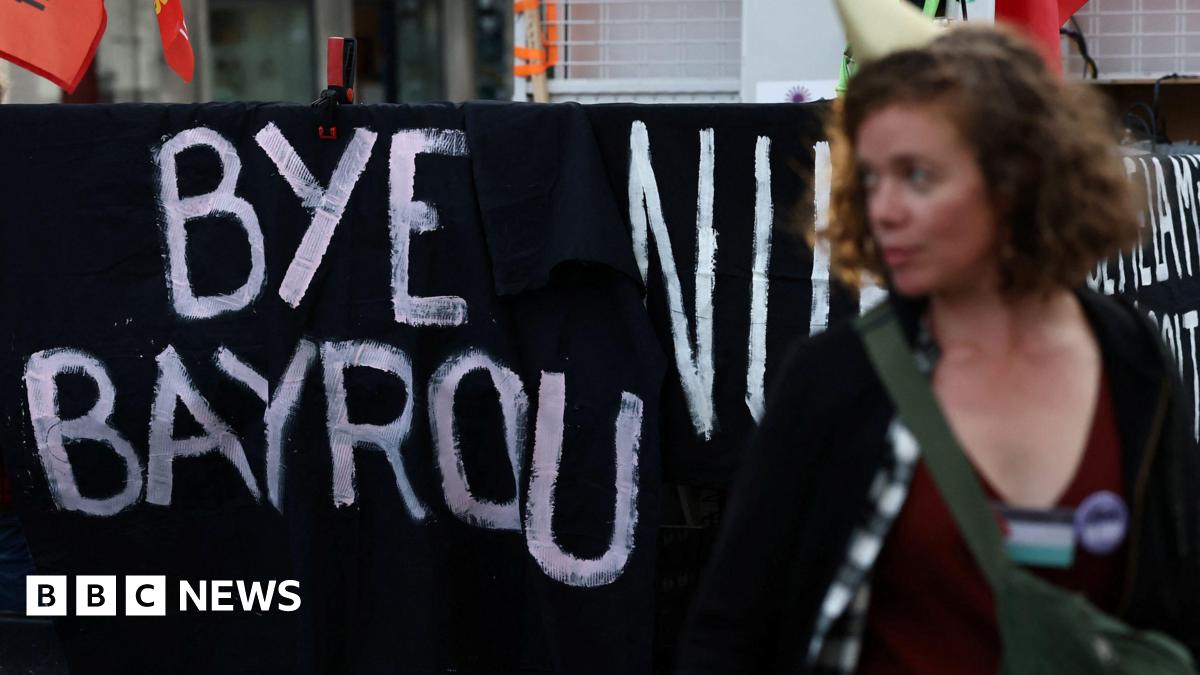

Instability In France Aftermath Of Prime Ministers Dismissal

Sep 10, 2025

Instability In France Aftermath Of Prime Ministers Dismissal

Sep 10, 2025 -

World Cup 2022 Deconstructing Thomas Tuchels Game Plan

Sep 10, 2025

World Cup 2022 Deconstructing Thomas Tuchels Game Plan

Sep 10, 2025 -

Trump Blasts Powell After Latest Jobs Report Fuels Rate Cut Delay Criticism

Sep 10, 2025

Trump Blasts Powell After Latest Jobs Report Fuels Rate Cut Delay Criticism

Sep 10, 2025 -

Oklahoma City Thunder Lock Up Josh Giddey With Record Breaking Contract

Sep 10, 2025

Oklahoma City Thunder Lock Up Josh Giddey With Record Breaking Contract

Sep 10, 2025

Latest Posts

-

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025 -

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025 -

Analyzing Tuchels World Cup Game Plan A Focus On Aerial Play

Sep 10, 2025

Analyzing Tuchels World Cup Game Plan A Focus On Aerial Play

Sep 10, 2025 -

Supreme Court To Decide On Trumps Plan For Massive Foreign Aid Cuts

Sep 10, 2025

Supreme Court To Decide On Trumps Plan For Massive Foreign Aid Cuts

Sep 10, 2025 -

World Cup 2023 Deconstructing Thomas Tuchels Playing Style

Sep 10, 2025

World Cup 2023 Deconstructing Thomas Tuchels Playing Style

Sep 10, 2025