Federal Reserve's 2025 Rate Cut Projection Affects U.S. Treasury Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Federal Reserve's 2025 Rate Cut Projection Sends Ripples Through U.S. Treasury Market

The Federal Reserve's recent projection of potential interest rate cuts in 2025 has sent shockwaves through the U.S. Treasury market, prompting significant shifts in investor sentiment and bond yields. This unexpected forecast, deviating from previous hawkish stances, underscores the evolving economic landscape and its impact on government borrowing costs.

A Shift in Monetary Policy Expectations

For months, the Fed maintained a strong commitment to combating inflation, even at the cost of potentially slowing economic growth. This led to a series of aggressive interest rate hikes, pushing yields on U.S. Treasury bonds – a benchmark for global borrowing costs – to multi-year highs. However, the projected rate cuts in 2025, hinted at in the latest Federal Open Market Committee (FOMC) meeting minutes, signal a potential pivot towards a more accommodative monetary policy. This shift reflects a growing confidence that inflation is finally under control and that the economy can withstand lower interest rates.

Impact on Treasury Yields and Bond Prices

The immediate reaction in the Treasury market was a noticeable decline in yields across the curve. Longer-term Treasury yields, particularly those maturing in 2025 and beyond, experienced the most significant drops. This is because investors anticipate that lower interest rates will make existing higher-yielding bonds more attractive, driving up their prices and consequently lowering their yields. This inverse relationship between bond prices and yields is a fundamental principle of the fixed-income market.

What Does This Mean for Investors?

This change presents both opportunities and challenges for investors. Those holding longer-term Treasury bonds stand to benefit from increased prices. However, investors who bought bonds at higher yields might see their returns diminished. The uncertainty surrounding the Fed's future actions also increases market volatility, making it crucial for investors to adopt a strategic and diversified approach.

Analyzing the Underlying Economic Factors

Several factors contribute to the Fed's more optimistic outlook. While inflation remains above the target rate, recent data suggests a cooling trend. Furthermore, the resilience of the U.S. labor market, while a positive sign for the economy, also contributes to the Fed's cautious approach. A strong labor market can lead to wage pressures, potentially reigniting inflationary pressures. The Fed is carefully balancing the need to cool inflation with the risk of triggering a recession.

Looking Ahead: Uncertainty and Volatility

While the 2025 rate cut projection provides a glimpse into the Fed's potential future course, significant uncertainty remains. The actual timing and magnitude of any rate cuts will depend on a multitude of economic indicators, including inflation data, employment figures, and overall economic growth. This inherent uncertainty contributes to the volatility experienced in the Treasury market, prompting investors to closely monitor economic data releases and Fed pronouncements.

Key Takeaways:

- Shifting Fed Stance: The Fed's projection of rate cuts in 2025 marks a significant shift from its previous hawkish stance.

- Impact on Treasury Yields: Lower projected rates have led to a decline in Treasury yields, particularly for longer-term bonds.

- Investor Implications: Investors need to adjust their strategies to account for this evolving market environment.

- Economic Uncertainty: The future path of interest rates remains uncertain, contributing to market volatility.

The Federal Reserve's actions continue to be a major driver of the U.S. Treasury market. Investors and economists alike will be closely watching for further indications of the Fed's future monetary policy decisions and their impact on the broader economy. Staying informed about these developments is crucial for navigating the complexities of the financial markets. For further analysis and insights, consult reputable financial news sources and consider seeking advice from qualified financial professionals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Federal Reserve's 2025 Rate Cut Projection Affects U.S. Treasury Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rare St Louis Tornado Leaves Path Of Destruction Recovery Efforts Underway

May 20, 2025

Rare St Louis Tornado Leaves Path Of Destruction Recovery Efforts Underway

May 20, 2025 -

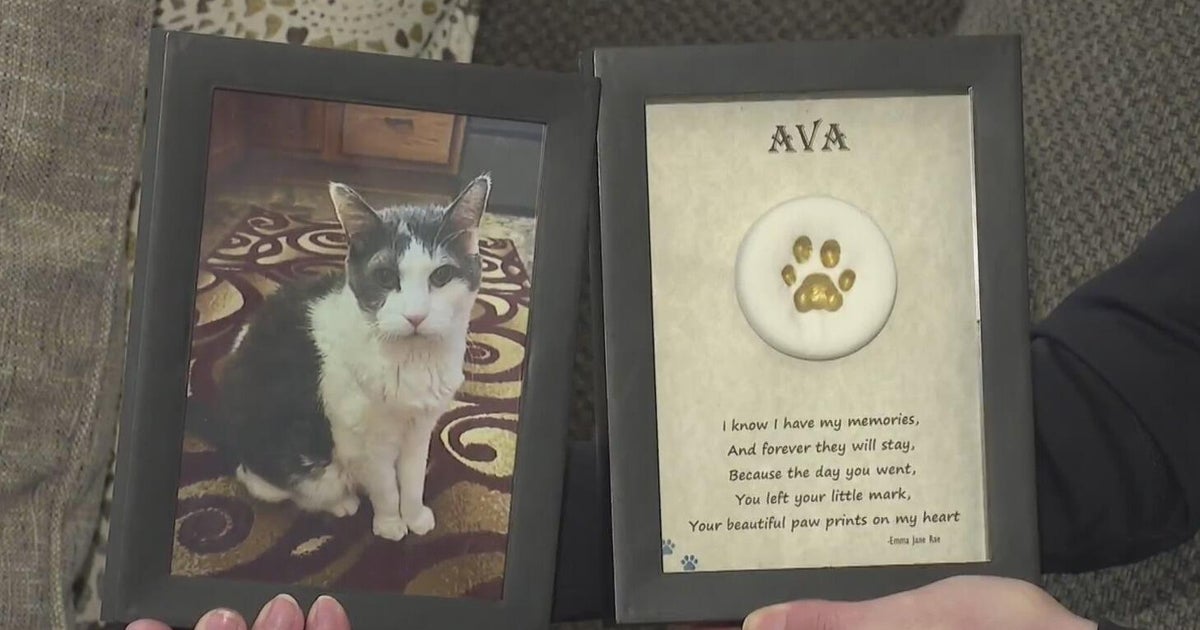

Lost Pets Honored Memorial Service After Funeral Home Cremains Scandal

May 20, 2025

Lost Pets Honored Memorial Service After Funeral Home Cremains Scandal

May 20, 2025 -

Watch Now A Gripping Wwi Drama With Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Watch Now A Gripping Wwi Drama With Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025 -

Jamie Lee Curtis And Lindsay Lohan A Mother Daughter Bond

May 20, 2025

Jamie Lee Curtis And Lindsay Lohan A Mother Daughter Bond

May 20, 2025 -

Commuters Fury The Bare Beating Phenomenon Explained

May 20, 2025

Commuters Fury The Bare Beating Phenomenon Explained

May 20, 2025

Latest Posts

-

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025 -

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025 -

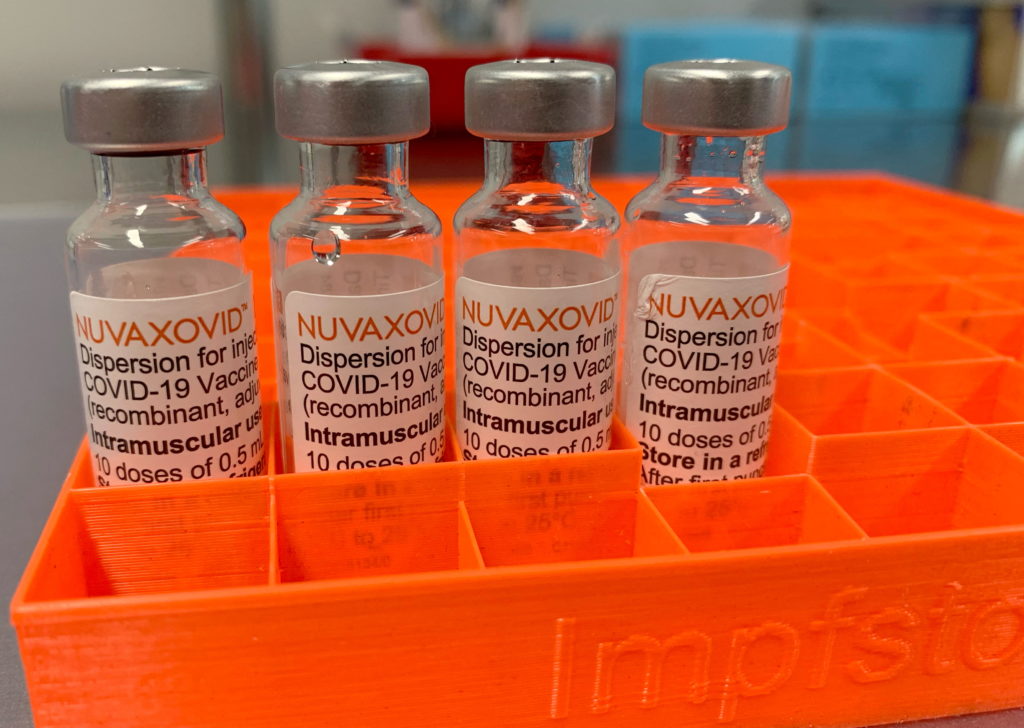

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025 -

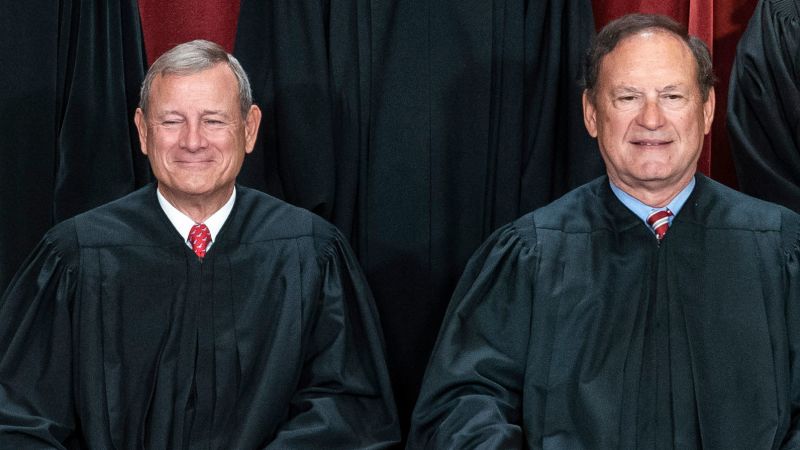

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025 -

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025