Moody's Downgrade Unfazed: Stock Market Soars, S&P 500 Hits Six-Day High

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Unfazed: Stock Market Soars, S&P 500 Hits Six-Day High

The stock market defied expectations yesterday, soaring to new heights despite Moody's Investors Service downgrading the credit rating of 10 small and midsize banks. The unexpected resilience sent a powerful signal of investor confidence, with the S&P 500 reaching a six-day high. This move challenges the narrative that credit rating downgrades automatically trigger widespread market turmoil.

A Day of Defiance Against Downgrade Fears:

The market's reaction to Moody's announcement was a stark contrast to the initial anxieties. Many analysts predicted a significant sell-off following the downgrade, citing concerns about potential contagion within the banking sector. However, the market largely shrugged off these concerns, demonstrating a remarkable level of stability and even enthusiasm. The S&P 500's robust performance underscores the complex interplay of factors influencing investor sentiment. This wasn't just a single day's fluctuation; the broader trend shows a persistent market strength that many experts are now analyzing.

What Drove the Unexpected Surge?

Several factors likely contributed to the market's surprising strength. These include:

-

Stronger-than-expected corporate earnings: Recent positive earnings reports from several major companies helped bolster investor confidence, offsetting the negative impact of the Moody's downgrade. This highlights the significance of consistent strong performance from key players in various market sectors. [Link to relevant financial news source about corporate earnings]

-

Resilience of the US Economy: Despite persistent inflation and interest rate hikes, the US economy continues to show signs of resilience. This underlying economic strength has likely provided a buffer against negative news, such as the Moody's downgrade. [Link to a reputable source on US economic indicators]

-

Investor Sentiment and Market Psychology: Market psychology plays a crucial role. The market's reaction might also reflect a growing belief among investors that the banking sector is robust enough to withstand these downgrades, indicating a more positive outlook on the long-term financial health of these institutions.

-

Technical Factors: Some analysts point to technical factors, such as short-covering and bargain hunting, as contributing to the market's surge. This suggests that the market's move was, in part, a response to short-term trading strategies rather than a fundamental shift in investor sentiment.

Looking Ahead: Sustained Growth or Temporary Rally?

While yesterday's market performance was undoubtedly impressive, it remains to be seen whether this represents a sustained trend or a temporary rally. The impact of Moody's downgrade might still unfold over time, and other unforeseen economic factors could influence market behavior.

The coming weeks will be crucial in determining the long-term implications of Moody's actions and the overall health of the financial system. Closely monitoring economic indicators, corporate earnings, and investor sentiment will be essential for navigating the market's future trajectory. Further analysis of market movements and their relation to wider economic conditions is vital for informed investment decisions.

Call to Action: Stay informed on the latest market trends by subscribing to our newsletter for daily updates and expert analysis. [Link to newsletter signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Unfazed: Stock Market Soars, S&P 500 Hits Six-Day High. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Assessing Putins Strategy Minimizing Trumps Role On The World Stage

May 21, 2025

Assessing Putins Strategy Minimizing Trumps Role On The World Stage

May 21, 2025 -

Bold Bets Fuel Bitcoin Etf Growth Over 5 Billion Invested

May 21, 2025

Bold Bets Fuel Bitcoin Etf Growth Over 5 Billion Invested

May 21, 2025 -

International Condemnation Following Israeli Attack On Gazas Final Northern Hospital

May 21, 2025

International Condemnation Following Israeli Attack On Gazas Final Northern Hospital

May 21, 2025 -

Bitcoin Etf Investments Exceed 5 Billion Analyzing The Market Trend

May 21, 2025

Bitcoin Etf Investments Exceed 5 Billion Analyzing The Market Trend

May 21, 2025 -

Us Treasury Market Reacts Yields Fall On Feds 2025 Rate Cut Outlook

May 21, 2025

Us Treasury Market Reacts Yields Fall On Feds 2025 Rate Cut Outlook

May 21, 2025

Latest Posts

-

Post Office Data Breach Hundreds To Receive Compensation

May 21, 2025

Post Office Data Breach Hundreds To Receive Compensation

May 21, 2025 -

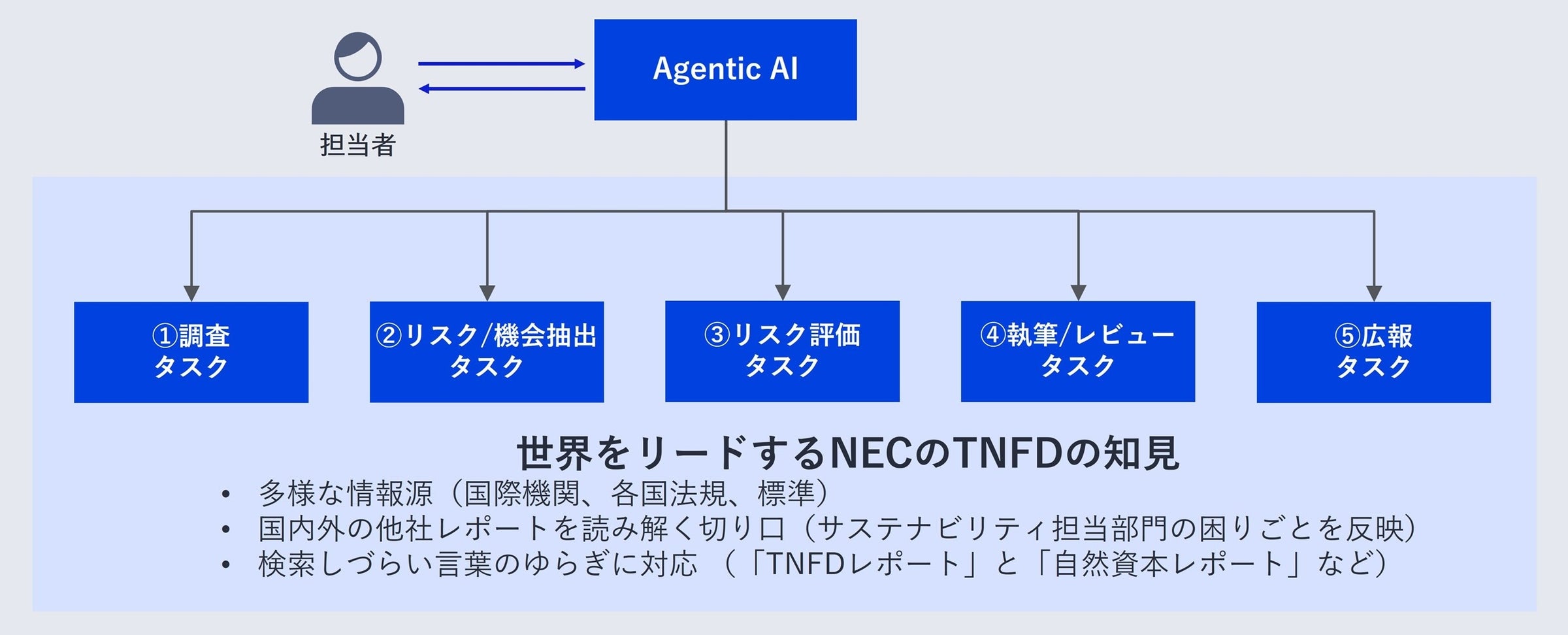

Nec Ai Agentic Ai Tnfd

May 21, 2025

Nec Ai Agentic Ai Tnfd

May 21, 2025 -

May 21, 2025

May 21, 2025 -

Church Bathroom Vandalized Two Boys Face Charges

May 21, 2025

Church Bathroom Vandalized Two Boys Face Charges

May 21, 2025 -

Monkey Kidnappings On A Panamanian Island Unraveling The Puzzle

May 21, 2025

Monkey Kidnappings On A Panamanian Island Unraveling The Puzzle

May 21, 2025