Profiting From Broadcom Earnings: A Deep Dive Into Options Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Profiting from Broadcom Earnings: A Deep Dive into Options Strategies

Broadcom (AVGO) earnings season is upon us, and for savvy investors, this presents a lucrative opportunity. But navigating the volatility surrounding earnings announcements requires a strategic approach. This deep dive explores how options trading can help you profit from Broadcom's earnings, regardless of whether the results beat or miss expectations. Caution: Options trading involves substantial risk and is not suitable for all investors.

Understanding the Volatility of Earnings Announcements

Earnings reports are notorious for causing significant price swings in a company's stock. Broadcom, a major player in semiconductor technology, is no exception. The uncertainty surrounding the announcement creates an environment ripe for options trading strategies that can capitalize on these price movements. Investors often see increased implied volatility (IV) leading up to and immediately following the release, creating opportunities to profit from both directional and non-directional moves.

Options Strategies for Broadcom Earnings:

Several options strategies can be employed to profit from Broadcom's earnings announcement. Here are a few popular choices:

1. Long Straddle: This strategy involves buying both a call and a put option with the same strike price and expiration date. It profits from significant price movement in either direction, making it ideal when you anticipate high volatility but are unsure of the direction. A long straddle benefits from large price swings exceeding the combined premium paid.

2. Long Strangle: Similar to a straddle, a strangle involves buying both a call and a put option, but with different strike prices. The call option has a higher strike price than the put, making it cheaper than a straddle. It profits from large price movements but requires a bigger price move to profit compared to a straddle.

3. Covered Call Writing: If you're bullish on Broadcom and already own shares, writing covered calls can generate income. This strategy involves selling call options against your existing stock. You profit from the premium received, but your upside is capped at the strike price of the call option.

4. Protective Put: If you're holding Broadcom stock and want to protect against potential losses, buying a put option can act as insurance. The put option limits your downside risk, allowing you to profit if the stock price remains above the put's strike price minus the premium paid.

Choosing the Right Strategy:

The optimal strategy depends heavily on your risk tolerance, market outlook, and understanding of Broadcom's business fundamentals. Thorough research, including analysis of recent financial reports, analyst predictions, and industry trends, is crucial. Consider the following factors:

- Implied Volatility (IV): Higher IV generally means more expensive options, offering greater profit potential but also higher risk.

- Strike Price Selection: Carefully choose strike prices based on your expected price movement and risk tolerance.

- Expiration Date: Options with shorter expiration dates offer higher premiums but carry greater risk.

Risk Management is Paramount:

Remember, options trading is inherently risky. Always manage your risk by:

- Diversifying your portfolio: Don't put all your eggs in one basket.

- Setting stop-loss orders: Limit potential losses.

- Only trading with capital you can afford to lose: Never invest more than you're comfortable losing.

Conclusion:

Profiting from Broadcom earnings requires careful planning and a deep understanding of options trading. By strategically employing options strategies like long straddles, long strangles, covered calls, or protective puts, and by diligently managing risk, investors can potentially capitalize on the volatility surrounding earnings announcements. However, always remember to conduct thorough research and understand the risks involved before entering any options trades. Consult with a financial advisor if needed.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money. Always conduct your own thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Profiting From Broadcom Earnings: A Deep Dive Into Options Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sneaker Frenzy Hundreds Queue For New 110s At Jd Sports

Jun 06, 2025

Sneaker Frenzy Hundreds Queue For New 110s At Jd Sports

Jun 06, 2025 -

Landmark Ruling Supreme Court Sides With Woman In Reverse Discrimination Dispute

Jun 06, 2025

Landmark Ruling Supreme Court Sides With Woman In Reverse Discrimination Dispute

Jun 06, 2025 -

Man Arrested In New York For Explosion At California Fertility Clinic

Jun 06, 2025

Man Arrested In New York For Explosion At California Fertility Clinic

Jun 06, 2025 -

Robinhoods Future Factors Influencing Stock Price And Investor Confidence

Jun 06, 2025

Robinhoods Future Factors Influencing Stock Price And Investor Confidence

Jun 06, 2025 -

Broadcom Earnings Impact Analyzing Trader Predictions For Avgo Stock Price

Jun 06, 2025

Broadcom Earnings Impact Analyzing Trader Predictions For Avgo Stock Price

Jun 06, 2025

Latest Posts

-

June 6th 2024 Maxwell Anderson Faces Trial For Sade Robinsons Death

Jun 07, 2025

June 6th 2024 Maxwell Anderson Faces Trial For Sade Robinsons Death

Jun 07, 2025 -

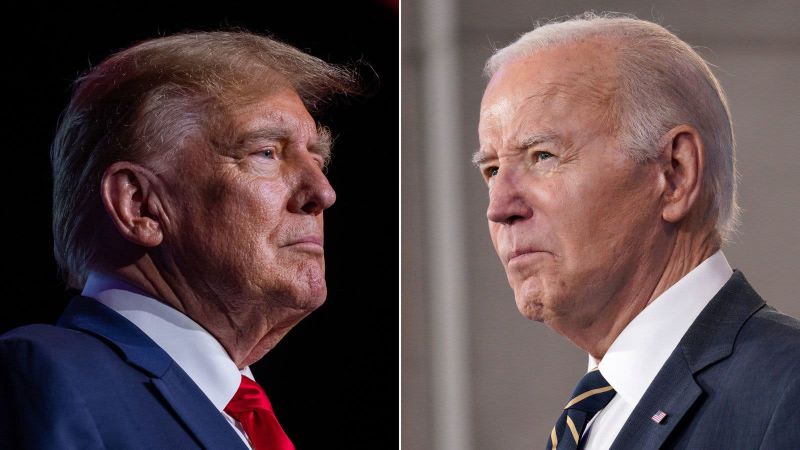

Cognitive Decline Allegations Fuel Trumps Investigation Into Biden

Jun 07, 2025

Cognitive Decline Allegations Fuel Trumps Investigation Into Biden

Jun 07, 2025 -

Maxwell Anderson Trial Begins Remembering Sade Robinson

Jun 07, 2025

Maxwell Anderson Trial Begins Remembering Sade Robinson

Jun 07, 2025 -

Preventing Hospitalization The Role Of The Infant Microbiome

Jun 07, 2025

Preventing Hospitalization The Role Of The Infant Microbiome

Jun 07, 2025 -

Longtime Friend Of Cassie Ventura To Testify Day Two In Combs Case

Jun 07, 2025

Longtime Friend Of Cassie Ventura To Testify Day Two In Combs Case

Jun 07, 2025