Should You Invest In SiriusXM Holdings In 2024? A Detailed Analysis.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in SiriusXM Holdings in 2024? A Detailed Analysis

SiriusXM Holdings (SIRI) has carved a niche for itself in the entertainment industry, offering satellite radio and streaming services. But with the ever-evolving landscape of audio entertainment, is it a worthwhile investment in 2024? This detailed analysis explores the pros and cons, examining the company's financial performance, competitive advantages, and future prospects.

SiriusXM's Strengths: A Resilient Business Model

SiriusXM boasts a robust, subscription-based business model, providing a relatively predictable revenue stream. This model is less susceptible to the fluctuating advertising revenue that plagues many other media companies. Their subscriber base remains substantial, proving the enduring appeal of their curated content.

- Strong Brand Recognition: SiriusXM is a household name, synonymous with satellite radio. This brand recognition translates into customer loyalty and a significant competitive advantage.

- Exclusive Content: The company offers exclusive content, including live sports, talk radio, and music programming not readily available on other platforms. This exclusivity enhances customer retention.

- Diverse Revenue Streams: While satellite radio forms the core of their business, SiriusXM is expanding into other areas, including connected vehicles and Pandora, diversifying their revenue streams and mitigating risk. This diversification strategy is crucial in a rapidly changing media landscape.

- Strategic Partnerships: SiriusXM actively collaborates with automakers, integrating their services into new vehicles. This symbiotic relationship secures a steady influx of new subscribers.

Challenges and Risks Facing SiriusXM

Despite its strengths, SiriusXM faces several challenges:

- Increased Competition: The rise of streaming services like Spotify and Apple Music poses a significant threat. These platforms offer a vast library of on-demand music for a competitive price, potentially luring away subscribers.

- Cord-Cutting Trend: The broader trend of cord-cutting, where consumers are abandoning traditional cable and satellite services, could indirectly impact SiriusXM's subscriber base.

- Dependence on the Automotive Industry: SiriusXM's close ties to the auto industry expose it to fluctuations within that sector. Economic downturns or shifts in consumer preferences for electric vehicles could impact their growth.

- Content Acquisition Costs: Securing exclusive content and paying royalties for music licensing can significantly impact profitability.

Financial Performance and Future Outlook

Analyzing SiriusXM's financial reports is crucial for assessing its investment potential. Look for consistent revenue growth, positive free cash flow, and a healthy debt-to-equity ratio. Consider factors like subscriber churn rate and average revenue per user (ARPU). While historical performance provides valuable insights, future projections depend on their ability to adapt to the evolving digital landscape. This includes maintaining subscriber growth, expanding into new markets, and leveraging technological advancements.

Should You Invest? The Verdict

Investing in SiriusXM in 2024 requires careful consideration. While the company has established a resilient business model and enjoys strong brand recognition, the intensifying competition in the audio entertainment space presents significant challenges.

Before investing, you should:

- Thoroughly review SiriusXM's financial statements. Pay close attention to revenue growth, profitability, and debt levels.

- Analyze their competitive landscape. Assess the threats posed by other streaming services and their strategies to combat these threats.

- Consider your own risk tolerance. Investing in SiriusXM carries inherent risks, and its future performance is not guaranteed.

- Consult a financial advisor. Seek professional advice tailored to your individual financial goals and risk profile.

Ultimately, the decision of whether or not to invest in SiriusXM Holdings in 2024 is a personal one. Conduct thorough due diligence, weigh the pros and cons carefully, and make an informed investment decision based on your own risk tolerance and financial objectives. This analysis provides a framework for your research, but it's not a substitute for professional financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In SiriusXM Holdings In 2024? A Detailed Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Anson Mount On The Most Challenging Scene In Star Trek Strange New Worlds

May 27, 2025

Anson Mount On The Most Challenging Scene In Star Trek Strange New Worlds

May 27, 2025 -

Why Amazon Amzn Stock Shows Strong Momentum In 2024

May 27, 2025

Why Amazon Amzn Stock Shows Strong Momentum In 2024

May 27, 2025 -

Ukraines Political Landscape Shaken Investigating The Death Of Andriy Portnov

May 27, 2025

Ukraines Political Landscape Shaken Investigating The Death Of Andriy Portnov

May 27, 2025 -

Two Sigmas Large Bank Of America Investment Analysis And Implications

May 27, 2025

Two Sigmas Large Bank Of America Investment Analysis And Implications

May 27, 2025 -

Alabama Based Firm Sells Bank Of America Shares Birmingham Capital Managements Recent Trade

May 27, 2025

Alabama Based Firm Sells Bank Of America Shares Birmingham Capital Managements Recent Trade

May 27, 2025

Latest Posts

-

Analyzing The Senate Gops Path To Passing Trumps Major Legislation

May 30, 2025

Analyzing The Senate Gops Path To Passing Trumps Major Legislation

May 30, 2025 -

George Straits Emotional Farewell A Touching Eulogy For A Beloved Friend

May 30, 2025

George Straits Emotional Farewell A Touching Eulogy For A Beloved Friend

May 30, 2025 -

Self Checkout Cameras Spark Debate At Tesco Stores

May 30, 2025

Self Checkout Cameras Spark Debate At Tesco Stores

May 30, 2025 -

Escorts Public Apology After Diddys Party Controversy Involving Cassie

May 30, 2025

Escorts Public Apology After Diddys Party Controversy Involving Cassie

May 30, 2025 -

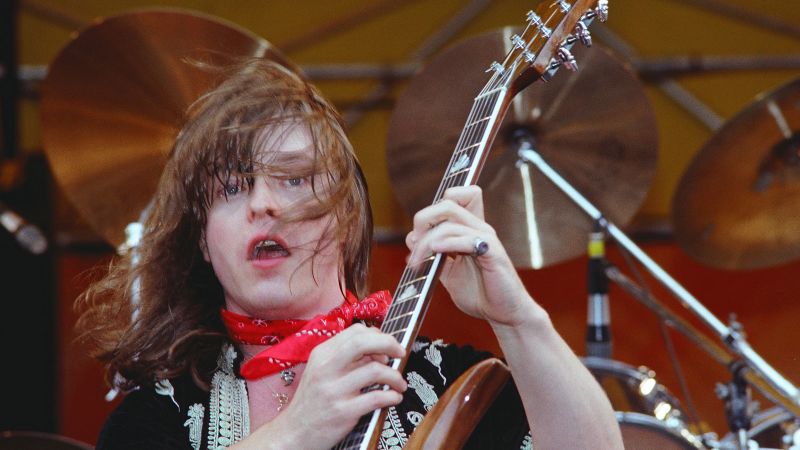

Weird Al Yankovic Mourns The Loss Of Guitarist Rick Derringer

May 30, 2025

Weird Al Yankovic Mourns The Loss Of Guitarist Rick Derringer

May 30, 2025