Six-Day Rally: S&P 500 Leads Market Surge After Moody's Credit Rating Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Six-Day Rally: S&P 500 Leads Market Surge After Moody's Credit Rating Downgrade – A Stunning Reversal

The stock market defied expectations this week, staging a remarkable six-day rally culminating in a significant surge for the S&P 500. This unexpected upward trend comes on the heels of Moody's downgrade of several small and mid-sized US banking institutions, an event that typically would trigger a market downturn. The resilience shown by the market has left many analysts scratching their heads and re-evaluating their predictions.

This unexpected market behavior highlights the complex and often unpredictable nature of the financial world. While Moody's downgrade raised concerns about the stability of the banking sector, several factors contributed to this surprising rally, defying initial predictions of a significant market correction.

What Drove the Six-Day Rally?

Several factors likely contributed to this unexpected market surge:

-

Resilient Economic Data: Recent economic indicators, such as stronger-than-expected job growth and consumer spending, have painted a more optimistic picture than initially anticipated, bolstering investor confidence. This positive economic data countered the negative sentiment stemming from the credit rating downgrade. Learn more about the latest economic indicators from the .

-

Bargain Hunting: The initial dip following the Moody's downgrade presented an opportunity for bargain hunting. Savvy investors saw the sell-off as a chance to acquire quality stocks at discounted prices, fueling the subsequent rally.

-

Central Bank Influence: While the Federal Reserve's actions haven't directly caused the rally, their consistent messaging regarding inflation control, although potentially leading to further interest rate hikes, has provided some degree of market stability and predictability. This clarity, while potentially challenging for some sectors, offers a framework for investors to make informed decisions.

-

Tech Sector Strength: The technology sector, a significant driver of the S&P 500, played a crucial role in the rally. Strong performance from several tech giants boosted overall market sentiment. This resurgence in the tech sector indicates a continued belief in the long-term growth potential of these companies. For more in-depth analysis on the tech sector, check out .

Moody's Downgrade: A Catalyst for Unexpected Growth?

While the Moody's downgrade initially shook investor confidence, the market’s response reveals a fascinating paradox. The unexpected rally suggests that the market may have already priced in much of the negative news, or that investors are focusing on the broader economic picture rather than specific banking sector concerns. This highlights the inherent volatility and the importance of long-term investment strategies.

What Does This Mean for Investors?

This unexpected rally presents a complex scenario for investors. While it's tempting to jump on the bandwagon, caution remains warranted. The market remains volatile, and future movements could be influenced by factors beyond current predictions. Investors should carefully consider their risk tolerance and diversification strategies.

Looking Ahead:

The coming weeks will be crucial in determining the sustainability of this six-day rally. Close monitoring of economic indicators, Federal Reserve decisions, and further developments within the banking sector will be essential. The market’s resilience in the face of adversity is noteworthy, but it’s too early to definitively declare this as a sustained upward trend. Further analysis is needed to understand the long-term implications of this surprising market behavior. Stay informed and consult with a financial advisor before making any significant investment decisions.

Keywords: S&P 500, Stock Market Rally, Moody's Downgrade, Credit Rating, Market Volatility, Economic Indicators, Investment Strategy, Banking Sector, Federal Reserve, Tech Sector, Six-Day Rally, Market Surge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Six-Day Rally: S&P 500 Leads Market Surge After Moody's Credit Rating Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Era For Air Force One Exploring The Presidential Planes Interior And Upgrades

May 20, 2025

New Era For Air Force One Exploring The Presidential Planes Interior And Upgrades

May 20, 2025 -

Moodys Downgrade Unshakes Market S And P 500 Extends Winning Streak Dow And Nasdaq Climb

May 20, 2025

Moodys Downgrade Unshakes Market S And P 500 Extends Winning Streak Dow And Nasdaq Climb

May 20, 2025 -

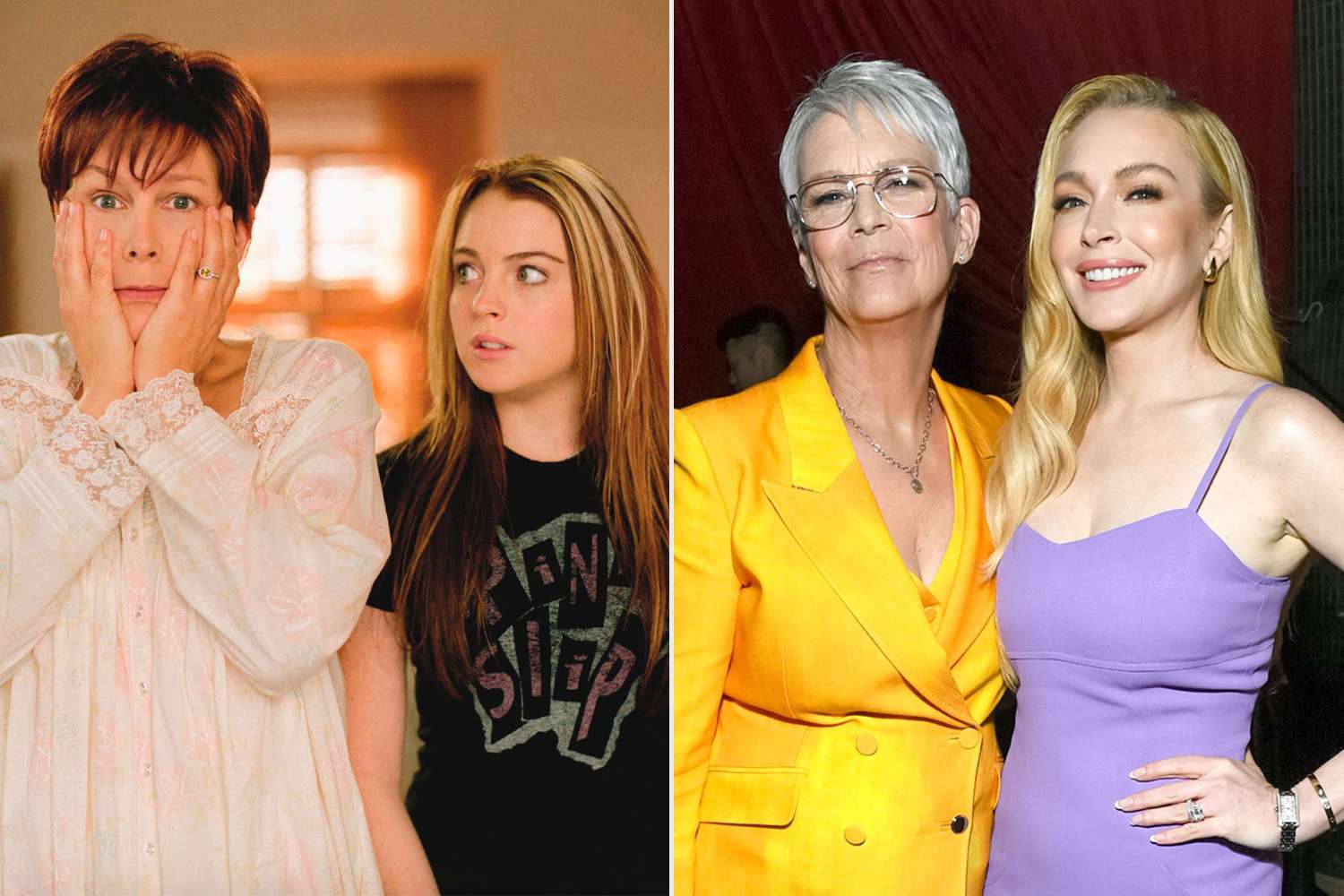

Exclusive Interview Jamie Lee Curtis On Her Relationship With Lindsay Lohan Following Freaky Friday

May 20, 2025

Exclusive Interview Jamie Lee Curtis On Her Relationship With Lindsay Lohan Following Freaky Friday

May 20, 2025 -

S And P 500 Extends Winning Run Market Update On Dow Nasdaq Performance

May 20, 2025

S And P 500 Extends Winning Run Market Update On Dow Nasdaq Performance

May 20, 2025 -

Missing For 3 Weeks Woman Found Alive In California Mountains Tells Her Story

May 20, 2025

Missing For 3 Weeks Woman Found Alive In California Mountains Tells Her Story

May 20, 2025

Latest Posts

-

Lineker Exit Bbc Faces Fallout After Match Of The Day Controversy

May 20, 2025

Lineker Exit Bbc Faces Fallout After Match Of The Day Controversy

May 20, 2025 -

Tense Standoff Eu Brexit Negotiations Enter Final Fraught Stages

May 20, 2025

Tense Standoff Eu Brexit Negotiations Enter Final Fraught Stages

May 20, 2025 -

Cyberattack Exposes Sensitive Data Including Criminal Records From Legal Aid

May 20, 2025

Cyberattack Exposes Sensitive Data Including Criminal Records From Legal Aid

May 20, 2025 -

U S Treasury Yield Slip Federal Reserves 2025 Rate Cut Outlook

May 20, 2025

U S Treasury Yield Slip Federal Reserves 2025 Rate Cut Outlook

May 20, 2025 -

Should Your Child Stop Sucking Their Thumb Or Pacifier Expert Advice

May 20, 2025

Should Your Child Stop Sucking Their Thumb Or Pacifier Expert Advice

May 20, 2025