Stock Market Surge: S&P 500's 6-Day Rally, Dow & Nasdaq Gains Defy Moody's Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Surge: S&P 500's 6-Day Rally Defies Moody's Downgrade

The stock market defied expectations this week, staging a remarkable six-day rally that saw significant gains across major indices, including the S&P 500, Dow Jones Industrial Average, and Nasdaq. This upward trend comes as a surprising counterpoint to Moody's recent downgrade of several US banking institutions, an event that many analysts predicted would trigger a market correction. The unexpected surge has left investors and economists alike questioning the future direction of the market.

A Six-Day Winning Streak: Unprecedented Resilience?

The S&P 500, a key indicator of overall market health, experienced a robust 6-day winning streak, culminating in a substantial percentage increase. This impressive performance follows a period of relative uncertainty and volatility. The Dow and Nasdaq also mirrored this positive momentum, exhibiting significant gains that defied the negative sentiment generated by the Moody's downgrade. This resilience suggests a level of underlying strength in the market that many had underestimated.

Moody's Downgrade and Market Reaction: A Tale of Two Narratives

Moody's decision to downgrade several US banks, citing concerns about the credit environment and rising interest rates, sent ripples of concern throughout the financial sector. Many experts predicted a sharp market downturn following the announcement. However, the market's response has been remarkably different. This divergence between expectation and reality highlights the complexity of market dynamics and the influence of multiple, often conflicting, factors.

Factors Contributing to the Unexpected Rally:

Several factors might contribute to this surprising market surge:

- Stronger-than-expected economic data: Recent economic indicators, such as [insert specific example, e.g., consumer confidence figures or employment data], have been more positive than anticipated, bolstering investor confidence.

- Resilience of the banking sector: While Moody's downgrade raised concerns, the overall stability of the US banking system appears to have held firm, mitigating the negative impact. The swift action taken by regulators in recent months might have played a significant role in this resilience.

- Anticipation of future interest rate hikes: Some analysts suggest that the market is already pricing in the possibility of further interest rate hikes by the Federal Reserve, potentially reducing the uncertainty surrounding future monetary policy.

- Strong corporate earnings: Upcoming corporate earnings reports could be another factor influencing investor sentiment. Positive earnings could further support the current upward trend.

What Lies Ahead? Uncertainty Remains

While the current market rally is impressive, it's crucial to approach it with caution. The long-term impact of the Moody's downgrade, coupled with ongoing economic uncertainty, remains unclear. The market’s behavior suggests a complex interplay of factors, making accurate predictions challenging. Investors should continue to monitor key economic indicators and geopolitical events closely.

Looking Ahead: Strategies for Navigating Market Volatility

Navigating market volatility requires a well-defined investment strategy. Consider diversifying your portfolio across different asset classes to mitigate risk and consult with a qualified financial advisor for personalized advice. Remember to conduct thorough research before making any investment decisions. Staying informed about market trends and economic news is crucial for making informed choices. [Link to relevant financial news source or resource].

Conclusion:

The recent stock market surge, defying the negative expectations following Moody's downgrade, presents a fascinating case study in market dynamics. While the rally is undeniably positive, it’s vital to maintain a balanced perspective and acknowledge the ongoing uncertainties facing the global economy. The coming weeks will be crucial in determining the sustainability of this upward trend. Staying informed and adopting a well-structured investment strategy are key to navigating the complexities of the current market landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Surge: S&P 500's 6-Day Rally, Dow & Nasdaq Gains Defy Moody's Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Putin Underscores Trumps Diminished Global Power

May 20, 2025

Putin Underscores Trumps Diminished Global Power

May 20, 2025 -

Air Force One A Glimpse Inside The Presidential Aircrafts New Era

May 20, 2025

Air Force One A Glimpse Inside The Presidential Aircrafts New Era

May 20, 2025 -

Can Duterte Balance Davaos Mayoralty With The Hagues Icc Case

May 20, 2025

Can Duterte Balance Davaos Mayoralty With The Hagues Icc Case

May 20, 2025 -

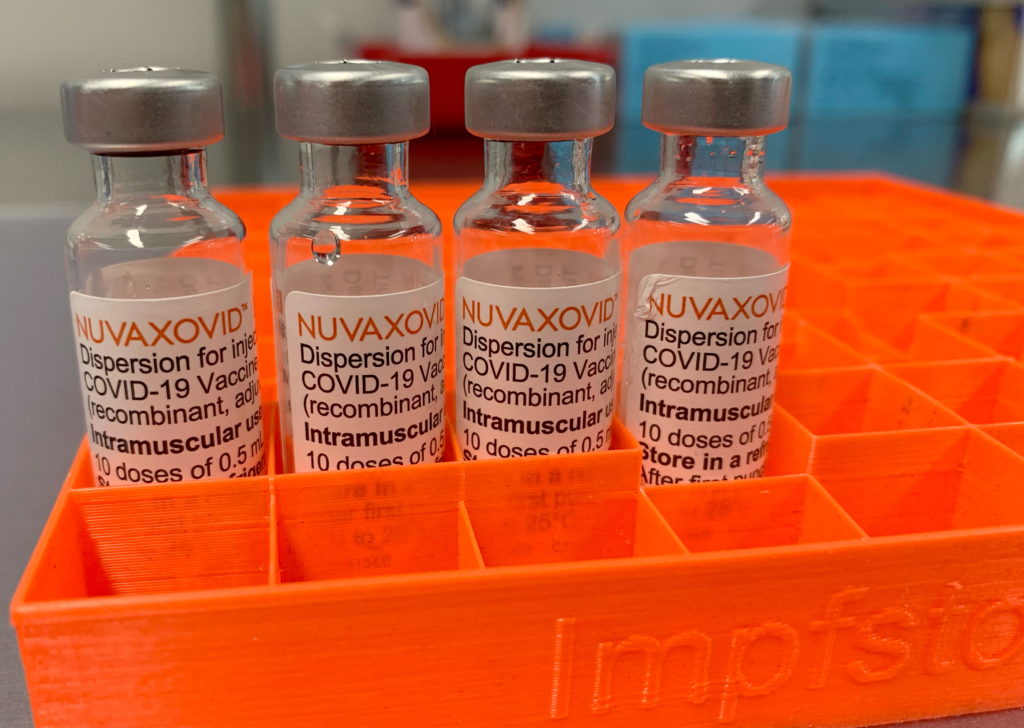

Conditional Fda Approval Novavax Covid 19 Vaccine Faces Usage Restrictions

May 20, 2025

Conditional Fda Approval Novavax Covid 19 Vaccine Faces Usage Restrictions

May 20, 2025 -

Toluca Vs America Enfrentamiento Definitivo Por El Titulo Del Clausura 2025 Liga Mx

May 20, 2025

Toluca Vs America Enfrentamiento Definitivo Por El Titulo Del Clausura 2025 Liga Mx

May 20, 2025

Latest Posts

-

Brett Favres Controversial Legacy A J Perez Discusses Threats And The Untold Fallout

May 20, 2025

Brett Favres Controversial Legacy A J Perez Discusses Threats And The Untold Fallout

May 20, 2025 -

Jamie Lee Curtis On Lindsay Lohan An Update On Their Post Freaky Friday Friendship

May 20, 2025

Jamie Lee Curtis On Lindsay Lohan An Update On Their Post Freaky Friday Friendship

May 20, 2025 -

Aspinall Injury Update Jon Jones Blasts Ufc For Lack Of Information

May 20, 2025

Aspinall Injury Update Jon Jones Blasts Ufc For Lack Of Information

May 20, 2025 -

Understanding The Impact Of New Buy Now Pay Later Regulations

May 20, 2025

Understanding The Impact Of New Buy Now Pay Later Regulations

May 20, 2025 -

A J Perez On The Making Of Untold Brett Favre And The Subsequent Threats

May 20, 2025

A J Perez On The Making Of Untold Brett Favre And The Subsequent Threats

May 20, 2025