Trump's Ire Intensifies: Powell's Rate Cuts Criticized After Latest Jobs Data

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Ire Intensifies: Powell's Rate Cuts Criticized After Latest Jobs Data

Strong jobs numbers fuel President Trump's criticism of Federal Reserve Chair Jerome Powell's recent interest rate cuts.

The latest jobs report, showing robust employment growth and a low unemployment rate, has ignited a fresh wave of criticism from President Donald Trump, squarely targeting Federal Reserve Chairman Jerome Powell's decision to lower interest rates. Trump, who has repeatedly pressured the Fed to stimulate the economy through rate cuts, now views the strong jobs data as evidence that these cuts were unnecessary and potentially harmful. This escalation marks a significant intensification of the ongoing tension between the White House and the central bank, raising questions about the future of monetary policy and the delicate balance between political pressure and economic independence.

A Clash of Economic Philosophies:

The conflict stems from fundamentally different perspectives on the current economic landscape. Trump argues that lower interest rates are crucial to boosting economic growth and maintaining his administration's economic achievements. He views the strong employment numbers as a sign of underlying strength that doesn't require further stimulus. Conversely, Powell and the Federal Reserve prioritize price stability and sustainable economic growth, aiming to prevent inflation while ensuring the economy remains on a healthy trajectory. The recent rate cuts were presented as a preemptive measure to mitigate potential risks to the economy, including slowing global growth and trade uncertainties. However, Trump’s interpretation suggests he believes these precautions are unwarranted given the positive jobs data.

<h3>The Jobs Report and its Implications:</h3>

The latest jobs report from the Bureau of Labor Statistics (BLS) revealed a significant increase in non-farm payroll employment, further lowering the unemployment rate. These positive figures paint a picture of a healthy economy, bolstering the arguments of those who believe further rate cuts are unnecessary. The data includes:

- Significant job growth: [Insert specific numbers from the BLS report here]

- Low unemployment rate: [Insert specific unemployment rate from the BLS report here]

- Positive wage growth: [Insert specific wage growth data from the BLS report here]

This robust data directly contradicts Trump's stated reasons for wanting lower interest rates. He previously argued that the economy needed a boost, suggesting that the current growth wasn't sufficient. The strong jobs numbers appear to undermine this claim.

<h3>The Political Fallout:</h3>

Trump's repeated attacks on Powell and the Federal Reserve raise concerns about the independence of the central bank. The Fed's mandate is to promote maximum employment and price stability, free from undue political influence. However, Trump’s persistent criticisms threaten to erode this independence, potentially impacting the Fed's ability to make objective decisions based on economic data rather than political considerations. This could have significant long-term consequences for the stability of the US economy. [Link to article about the importance of Fed independence here]

<h3>What Happens Next?</h3>

The coming weeks will be crucial in determining the trajectory of this conflict. The Federal Reserve's next meeting will be closely scrutinized for any indication of a shift in monetary policy. Whether Powell will yield to political pressure or maintain the Fed's independence remains to be seen. Furthermore, the impact of this ongoing disagreement on investor confidence and market stability will be a key factor to watch. The situation highlights the complex interplay between politics and economics and the potential ramifications of politicizing central bank decisions.

Call to Action: Stay informed about the latest developments in this evolving economic and political story by following reputable news sources and economic analysis. Understanding the complexities of monetary policy is crucial in navigating the current economic climate.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Ire Intensifies: Powell's Rate Cuts Criticized After Latest Jobs Data. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

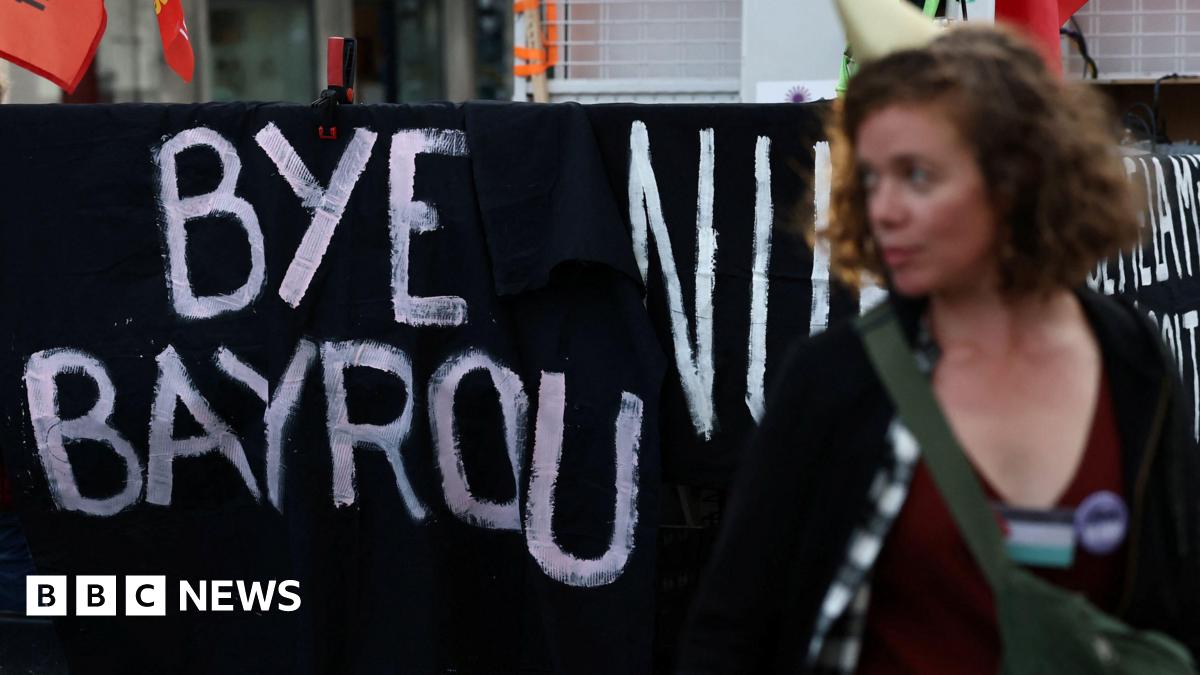

Frances Political Turmoil Whats Next For Macron And The Nation

Sep 10, 2025

Frances Political Turmoil Whats Next For Macron And The Nation

Sep 10, 2025 -

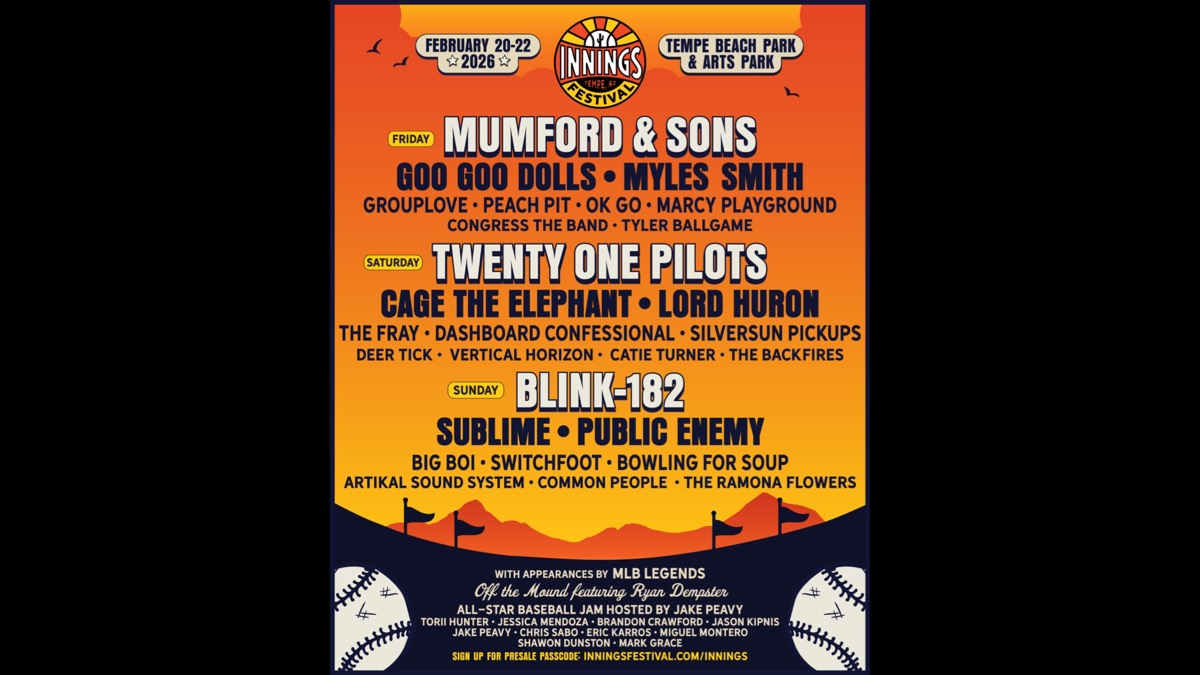

Innings Festival 2026 Lineup Tempe Concert Details

Sep 10, 2025

Innings Festival 2026 Lineup Tempe Concert Details

Sep 10, 2025 -

Innings Festival 2026 Tempe Lineup Unveiled

Sep 10, 2025

Innings Festival 2026 Tempe Lineup Unveiled

Sep 10, 2025 -

Franca Vs Islandia Eliminatorias Guia Completo Onde Assistir Horarios E Times

Sep 10, 2025

Franca Vs Islandia Eliminatorias Guia Completo Onde Assistir Horarios E Times

Sep 10, 2025 -

Major Headliners Revealed For Innings Festival 2026 A Look At The Lineup

Sep 10, 2025

Major Headliners Revealed For Innings Festival 2026 A Look At The Lineup

Sep 10, 2025

Latest Posts

-

Thunder Secure Giddeys Future Impact On Okcs Roster And Playoff Hopes

Sep 10, 2025

Thunder Secure Giddeys Future Impact On Okcs Roster And Playoff Hopes

Sep 10, 2025 -

French Parliament Votes Out Prime Minister Triggering Political Uncertainty

Sep 10, 2025

French Parliament Votes Out Prime Minister Triggering Political Uncertainty

Sep 10, 2025 -

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025 -

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025 -

Analyzing Tuchels World Cup Game Plan A Focus On Aerial Play

Sep 10, 2025

Analyzing Tuchels World Cup Game Plan A Focus On Aerial Play

Sep 10, 2025