US Treasury Market Reacts: Fed's Rate Cut Projection And Yield Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Market Reacts: Fed's Rate Cut Projection and Yield Implications

The US Treasury market experienced significant volatility following the Federal Reserve's latest monetary policy announcement, which included a projection for potential interest rate cuts later this year. This unexpected shift sent ripples through the bond market, impacting yields across the curve and sparking considerable debate among economists and investors. Understanding this reaction is crucial for anyone invested in or affected by the US financial system.

The Fed's Surprise Shift: A Pivot Towards Rate Cuts?

The Federal Open Market Committee (FOMC) surprised many analysts by signaling a potential pivot towards easing monetary policy. While inflation remains stubbornly high, concerns about slowing economic growth and potential banking sector instability seem to have swayed the Fed's decision. The projection of rate cuts, although not guaranteed, immediately impacted market expectations and triggered a significant response in the Treasury market. This change in sentiment represents a notable departure from the Fed's previous hawkish stance, focusing primarily on inflation control.

Impact on Treasury Yields:

The immediate reaction in the Treasury market was a sharp decline in yields. Longer-term yields, particularly those on 10-year and 30-year Treasury bonds, fell significantly. This inverse relationship between bond prices and yields reflects increased investor demand for the perceived safety of government bonds in a climate of uncertainty. The anticipation of lower interest rates makes existing higher-yielding bonds more attractive.

- 10-Year Treasury Yield: Experienced a notable drop, reflecting investor flight to safety and expectations of lower future interest rates. This decline suggests a shift in market sentiment towards a less aggressive monetary policy path.

- 2-Year Treasury Yield: While also impacted, showed a less dramatic decline compared to longer-term yields. This difference reflects the market's assessment of the near-term economic outlook and the timing of potential Fed rate cuts.

- Yield Curve: The yield curve, which illustrates the difference between yields of various maturities of Treasury bonds, flattened. This flattening is often interpreted as a signal of potential economic slowdown or recession.

Analysis and Outlook:

The market's reaction underscores the sensitivity of the Treasury market to changes in Federal Reserve policy. The projected rate cuts reflect a complex interplay of economic factors, including inflation, economic growth, and financial stability concerns. Several leading economists are now debating the implications of this shift, with some suggesting that the rate cuts might not be sufficient to stimulate the economy and others warning of potential inflationary pressures if the cuts are implemented too aggressively.

What This Means for Investors:

This situation presents both opportunities and challenges for investors. Those invested in fixed-income securities may see increased returns as yields fall, while those holding cash may find opportunities in higher-yielding bonds. However, the uncertainty surrounding the economic outlook and the Fed's future actions necessitates a cautious approach. Investors should carefully consider their risk tolerance and investment goals before making any significant portfolio adjustments.

Further Considerations:

- Inflation Data: Upcoming inflation data will play a crucial role in shaping future market expectations and influencing the Fed's decisions.

- Economic Growth: Indicators of economic growth, such as GDP and employment figures, will provide further insights into the economic outlook.

- Geopolitical Risks: Global geopolitical events can also significantly impact the Treasury market, adding to the overall uncertainty.

Conclusion:

The US Treasury market's reaction to the Fed's rate cut projection highlights the intricate relationship between monetary policy, market expectations, and economic outlook. While the decline in Treasury yields presents potential investment opportunities, it also underscores the inherent risks and uncertainties present in the current economic environment. Staying informed about economic developments and market trends is crucial for investors navigating this complex landscape. This ongoing situation warrants continued monitoring and careful consideration of the implications for your personal financial strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Market Reacts: Fed's Rate Cut Projection And Yield Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uber Claims Driverless Cars Ready Now Uk Experts Predict 2027 Launch

May 20, 2025

Uber Claims Driverless Cars Ready Now Uk Experts Predict 2027 Launch

May 20, 2025 -

California Mountain Rescue Tiffany Slatons Survival Account

May 20, 2025

California Mountain Rescue Tiffany Slatons Survival Account

May 20, 2025 -

Days After St Louis Tornado Surveying The Damage And The Road To Recovery

May 20, 2025

Days After St Louis Tornado Surveying The Damage And The Road To Recovery

May 20, 2025 -

Jjs Wasted Love An Austrian Eurovision 2025 Victory

May 20, 2025

Jjs Wasted Love An Austrian Eurovision 2025 Victory

May 20, 2025 -

Uk Autonomous Vehicle Deployment Ubers Optimism Vs Government Timeline

May 20, 2025

Uk Autonomous Vehicle Deployment Ubers Optimism Vs Government Timeline

May 20, 2025

Latest Posts

-

New Buy Now Pay Later Regulations What Shoppers Need To Know

May 21, 2025

New Buy Now Pay Later Regulations What Shoppers Need To Know

May 21, 2025 -

Helldivers 2 Warbond Event Master Of Ceremony Skins Drop May 15th

May 21, 2025

Helldivers 2 Warbond Event Master Of Ceremony Skins Drop May 15th

May 21, 2025 -

The Putin Trump Dynamic A Power Shift And Its Global Implications

May 21, 2025

The Putin Trump Dynamic A Power Shift And Its Global Implications

May 21, 2025 -

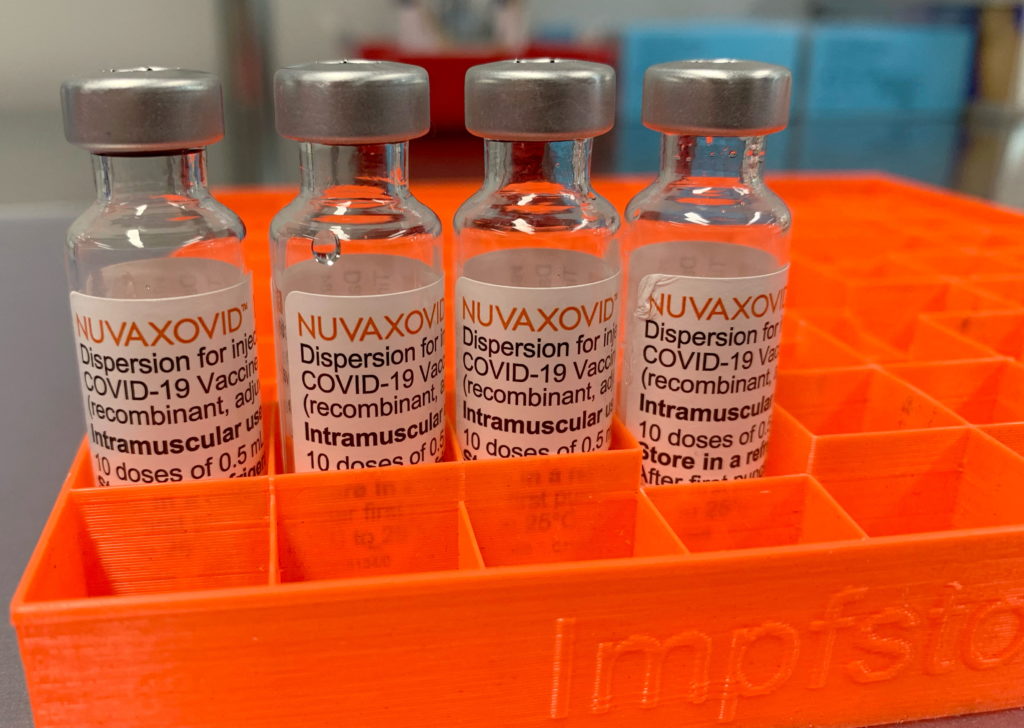

Novavax Covid 19 Vaccine Gets Fda Approval Understanding The Usage Restrictions

May 21, 2025

Novavax Covid 19 Vaccine Gets Fda Approval Understanding The Usage Restrictions

May 21, 2025 -

What Is Femicide Exploring The Causes Behind The Global Surge

May 21, 2025

What Is Femicide Exploring The Causes Behind The Global Surge

May 21, 2025