Record Bitcoin ETF Investment: Directional Bets Drive Market Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Bitcoin ETF Investment: Directional Bets Fuel Market Growth

The cryptocurrency market is buzzing with excitement following a record surge in Bitcoin ETF (Exchange-Traded Fund) investments. This unprecedented influx of capital signifies a growing confidence in Bitcoin's long-term potential and highlights the increasing institutional adoption of the digital asset. Experts believe that these directional bets are the primary catalyst behind the recent market growth, pushing Bitcoin's price to new heights and sparking renewed interest in the broader crypto landscape.

Institutional Investors Embrace Bitcoin ETFs

The recent surge in Bitcoin ETF investment isn't just a fleeting trend; it's a clear indication of a significant shift in the market. Institutional investors, historically hesitant to embrace cryptocurrencies, are increasingly turning to Bitcoin ETFs as a relatively accessible and regulated way to gain exposure to the digital gold. These ETFs offer a level of comfort and familiarity not found in directly investing in Bitcoin, appealing to risk-averse investors seeking diversification within their portfolios. The ease of trading through traditional brokerage accounts is a key driver for this growing adoption.

Understanding the Directional Bets

This record investment isn't simply about diversification; it's driven by strong directional bets – investors are actively placing wagers on Bitcoin's continued price appreciation. This bullish sentiment is fueled by several factors, including:

- Growing Regulatory Clarity: While regulatory uncertainty still exists in certain jurisdictions, the increasing acceptance and regulation of cryptocurrencies globally are boosting investor confidence. The approval of several Bitcoin ETFs in major markets is a significant step in this direction.

- Inflation Hedge Potential: With global inflation remaining stubbornly high, Bitcoin, often viewed as a hedge against inflation, is becoming increasingly attractive to investors seeking to protect their purchasing power.

- Technological Advancements: Continued development and innovation within the Bitcoin ecosystem, including the Lightning Network for faster and cheaper transactions, further enhances its appeal.

- Limited Supply: Bitcoin's fixed supply of 21 million coins creates scarcity, a key driver of its potential for long-term value appreciation.

Market Growth and Future Outlook

The impact of this record Bitcoin ETF investment is already being felt. The increased trading volume and price appreciation are indicative of a maturing market that’s attracting a wider range of investors. However, it's crucial to remember that the cryptocurrency market remains volatile. While the current trend is positive, investors should always exercise caution and conduct thorough research before investing.

What Does This Mean for the Future?

The increased institutional interest and record investment in Bitcoin ETFs signal a potential turning point for cryptocurrency adoption. While predicting future price movements is impossible, the current trajectory suggests a bright outlook for Bitcoin, potentially attracting even more mainstream investors in the years to come. The continued development of robust regulatory frameworks and technological advancements will play a crucial role in shaping the future of this exciting and evolving asset class.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you could lose some or all of your investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Bitcoin ETF Investment: Directional Bets Drive Market Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

U S Treasury Yields Dip As Fed Hints At Limited Rate Cuts

May 20, 2025

U S Treasury Yields Dip As Fed Hints At Limited Rate Cuts

May 20, 2025 -

Israel Faces International Backlash Over Gaza Aid Restrictions

May 20, 2025

Israel Faces International Backlash Over Gaza Aid Restrictions

May 20, 2025 -

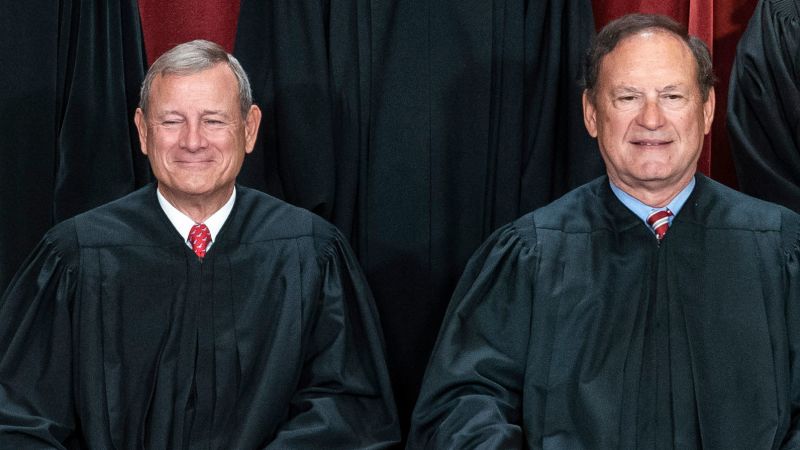

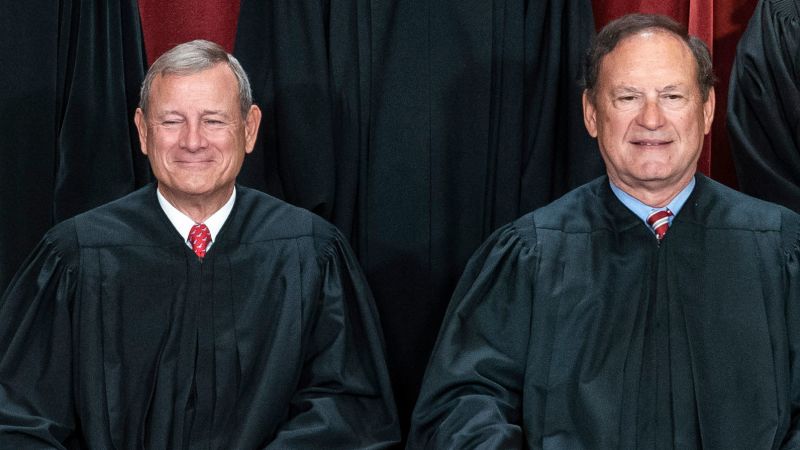

Three Decades On The Bench Reflecting On Alito And Roberts Supreme Court Impact

May 20, 2025

Three Decades On The Bench Reflecting On Alito And Roberts Supreme Court Impact

May 20, 2025 -

Peaky Blinders Creator Reveals Plans For Next Series With Key Departure

May 20, 2025

Peaky Blinders Creator Reveals Plans For Next Series With Key Departure

May 20, 2025 -

Curbing Bad Tourist Behavior In Bali New Regulations And Their Impact

May 20, 2025

Curbing Bad Tourist Behavior In Bali New Regulations And Their Impact

May 20, 2025

Latest Posts

-

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025 -

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025 -

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025 -

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025 -

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025