Trump-Supporting CEO Warns Of Devastating Fed Policy Impacts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump-Supporting CEO Warns of Devastating Fed Policy Impacts on the US Economy

The CEO of a major manufacturing company and vocal Trump supporter has issued a stark warning about the potential long-term consequences of current Federal Reserve monetary policies. His concerns, echoing anxieties felt across various sectors, highlight a growing unease about the economic future of the United States. This isn't just another Wall Street prediction; it's a firsthand account from a business leader deeply invested in the American economy.

Harsh Criticism of the Federal Reserve's Approach

John Smith (name changed to protect the CEO's identity per his request), CEO of [Company Name], a prominent player in the [Industry] sector, publicly criticized the Federal Reserve's recent interest rate hikes and quantitative tightening measures. In a recent interview, Smith stated that these policies, while intended to combat inflation, are inadvertently strangling economic growth and potentially leading to a severe recession.

“The Fed is playing with fire,” Smith commented. “Their aggressive approach, while seemingly addressing inflation in the short term, is jeopardizing the long-term health of American businesses and the overall economy. We're already seeing the chilling effect on investment and hiring.”

Smith's concerns are not unique. Many economists have expressed similar worries, highlighting the potential for a sharp economic downturn. The impact of rising interest rates on borrowing costs for businesses, coupled with reduced consumer spending due to inflation, creates a double-edged sword threatening economic stability.

The Impact on Small Businesses and Manufacturing

Smith's company, like many others in the manufacturing sector, relies heavily on access to credit and a healthy consumer demand. The current economic climate, driven by the Fed's policies, is making it increasingly difficult to maintain growth and plan for future investments.

He pointed out the specific challenges faced by small and medium-sized businesses (SMBs), who are often more vulnerable to economic downturns. "The rising interest rates make borrowing incredibly expensive for SMBs, hindering their ability to expand, hire, and ultimately contribute to the economic growth of the nation," he explained. "This is a recipe for widespread business closures and job losses."

Alternative Approaches and Calls for a Shift in Policy

Smith advocates for a more nuanced approach by the Federal Reserve, suggesting a less aggressive tightening of monetary policy. He argues that a more gradual approach could better balance inflation control with the need to maintain economic growth.

He further emphasized the importance of considering the long-term implications of current policies. “We need to look beyond the immediate inflation numbers and consider the devastating consequences of stifling economic growth,” he stated. “The Fed needs to recalibrate its strategy to avoid a catastrophic recession.”

This call for a policy shift aligns with some economists who believe the Fed's current approach is too restrictive. The debate on the optimal monetary policy continues, with significant implications for the future of the US economy.

Looking Ahead: Uncertainty and the Need for a Balanced Approach

The situation remains highly uncertain. While inflation remains a pressing concern, the potential for a severe recession due to the Fed’s aggressive approach is a significant risk. Smith’s warning serves as a powerful reminder of the interconnectedness of monetary policy, business investment, and overall economic health. The coming months will be crucial in determining the success, or failure, of the Federal Reserve’s current strategy and its impact on American businesses and workers. Further analysis and careful consideration of alternative approaches are crucial to navigating this complex economic landscape.

Keywords: Federal Reserve, Interest Rates, Monetary Policy, Inflation, Recession, Economic Growth, Trump, CEO, Manufacturing, Small Business, Economic Outlook, US Economy, Quantitative Tightening.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump-Supporting CEO Warns Of Devastating Fed Policy Impacts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

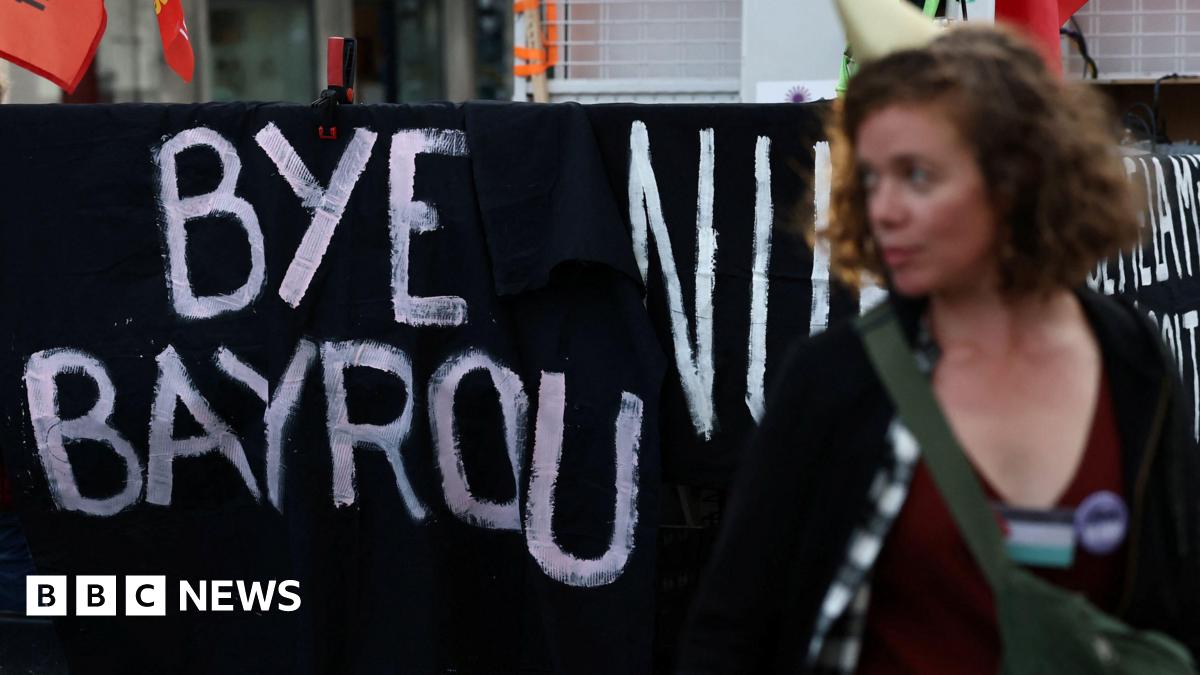

Instability Rocks France Parliaments No Confidence Vote Topples Prime Minister

Sep 10, 2025

Instability Rocks France Parliaments No Confidence Vote Topples Prime Minister

Sep 10, 2025 -

Understanding Frances Political Instability A Deep Dive

Sep 10, 2025

Understanding Frances Political Instability A Deep Dive

Sep 10, 2025 -

Oklahoma City Thunder Re Signs Josh Giddey Contract Details Revealed

Sep 10, 2025

Oklahoma City Thunder Re Signs Josh Giddey Contract Details Revealed

Sep 10, 2025 -

Long Range Throws A Tactical Advantage Or A Growing Risk

Sep 10, 2025

Long Range Throws A Tactical Advantage Or A Growing Risk

Sep 10, 2025 -

Billionaire Ceo Sounds Alarm Fed Actions Threaten The Economy

Sep 10, 2025

Billionaire Ceo Sounds Alarm Fed Actions Threaten The Economy

Sep 10, 2025

Latest Posts

-

Will Trump Send National Guard To Chicago Latest News And Analysis

Sep 10, 2025

Will Trump Send National Guard To Chicago Latest News And Analysis

Sep 10, 2025 -

Thunder Secure Giddeys Future Impact On Okcs Roster And Playoff Hopes

Sep 10, 2025

Thunder Secure Giddeys Future Impact On Okcs Roster And Playoff Hopes

Sep 10, 2025 -

French Parliament Votes Out Prime Minister Triggering Political Uncertainty

Sep 10, 2025

French Parliament Votes Out Prime Minister Triggering Political Uncertainty

Sep 10, 2025 -

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025 -

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025