Wall Street Defies Moody's: S&P 500, Dow, And Nasdaq Surge Higher

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Defies Moody's Downgrade: A Bullish Surge for S&P 500, Dow, and Nasdaq

Wall Street shrugged off Moody's Investors Service's downgrade of 10 US banks, staging a surprising rally that saw the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all surge higher. The unexpected market strength showcases investor resilience and perhaps a belief that the banking sector's challenges are contained. This defiance of a major credit rating agency's assessment is a significant development with potential long-term implications.

Moody's Downgrade and Market Reaction:

On August 7th, Moody's downgraded the credit ratings of several US banks, citing concerns about the rising interest rate environment and potential credit losses. This action sent ripples through the financial markets, initially sparking fears of a broader banking crisis. However, the market's subsequent response defied expectations. Instead of a widespread sell-off, investors seemed to dismiss the downgrade as largely priced-in, focusing instead on the broader economic outlook and corporate earnings.

S&P 500, Dow, and Nasdaq: A Triumphant Rally:

The S&P 500 saw a significant increase, closing the day up [insert percentage here], fueled by gains across various sectors. The Dow Jones Industrial Average also experienced a strong rally, closing [insert percentage here] higher. Technology stocks, heavily represented in the Nasdaq Composite, led the charge, with the Nasdaq soaring [insert percentage here] on the day. This collective surge reflects a surprising level of investor confidence.

Reasons Behind the Market's Resilience:

Several factors might explain this bullish response despite the negative news from Moody's:

- Stronger-than-Expected Corporate Earnings: Recent corporate earnings reports have, in many cases, exceeded analysts' expectations, bolstering investor confidence in the overall health of the economy. [Link to relevant financial news source about corporate earnings].

- Resilient Consumer Spending: Despite inflation concerns, consumer spending remains relatively robust, indicating a degree of economic strength that mitigates concerns about a potential recession. [Link to relevant economic data source on consumer spending].

- Federal Reserve's Actions: While interest rate hikes remain a concern, the Federal Reserve's measured approach and communication regarding monetary policy may be contributing to market stability. [Link to Federal Reserve website or relevant news article].

- Selective Downgrade Impact: The Moody's downgrade was not a blanket condemnation of the entire US banking system. The affected banks represent a specific segment, and many analysts believe the impact is likely to be contained.

Looking Ahead: Uncertainty Remains:

While the market’s positive response is noteworthy, it's crucial to acknowledge the ongoing uncertainty. The implications of Moody's downgrade, combined with geopolitical tensions and persistent inflationary pressures, warrant cautious optimism. The coming weeks will be crucial in determining whether this rally represents a sustained shift in market sentiment or a temporary reprieve.

What to Watch For:

Investors should closely monitor:

- Further announcements from credit rating agencies.

- Developments in the banking sector.

- Upcoming economic data releases.

- The Federal Reserve's next policy decision.

The unexpected market surge following Moody's downgrade highlights the complex interplay of factors influencing market dynamics. While the immediate reaction has been positive, maintaining a long-term perspective and staying informed about relevant developments remains essential for investors. This situation serves as a reminder of the unpredictable nature of the market and the importance of diversified investment strategies.

Keywords: Wall Street, Moody's, S&P 500, Dow Jones, Nasdaq, Stock Market, Banking Crisis, Credit Rating, Market Rally, Investor Confidence, Economic Outlook, Federal Reserve, Interest Rates, Corporate Earnings, Consumer Spending

(Remember to replace the bracketed information with actual data and relevant links.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Defies Moody's: S&P 500, Dow, And Nasdaq Surge Higher. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

St Louis Rebuilds Days After Devastating Tornado

May 20, 2025

St Louis Rebuilds Days After Devastating Tornado

May 20, 2025 -

Water Vole Conservation In Wales The Unexpected Role Of Glitter

May 20, 2025

Water Vole Conservation In Wales The Unexpected Role Of Glitter

May 20, 2025 -

Wales Vanishing Water Voles Investigating The Potential Of Glitter In Conservation

May 20, 2025

Wales Vanishing Water Voles Investigating The Potential Of Glitter In Conservation

May 20, 2025 -

Weight Comments And Grueling Training Olympic Swimmers Trauma Under Harsh Coach

May 20, 2025

Weight Comments And Grueling Training Olympic Swimmers Trauma Under Harsh Coach

May 20, 2025 -

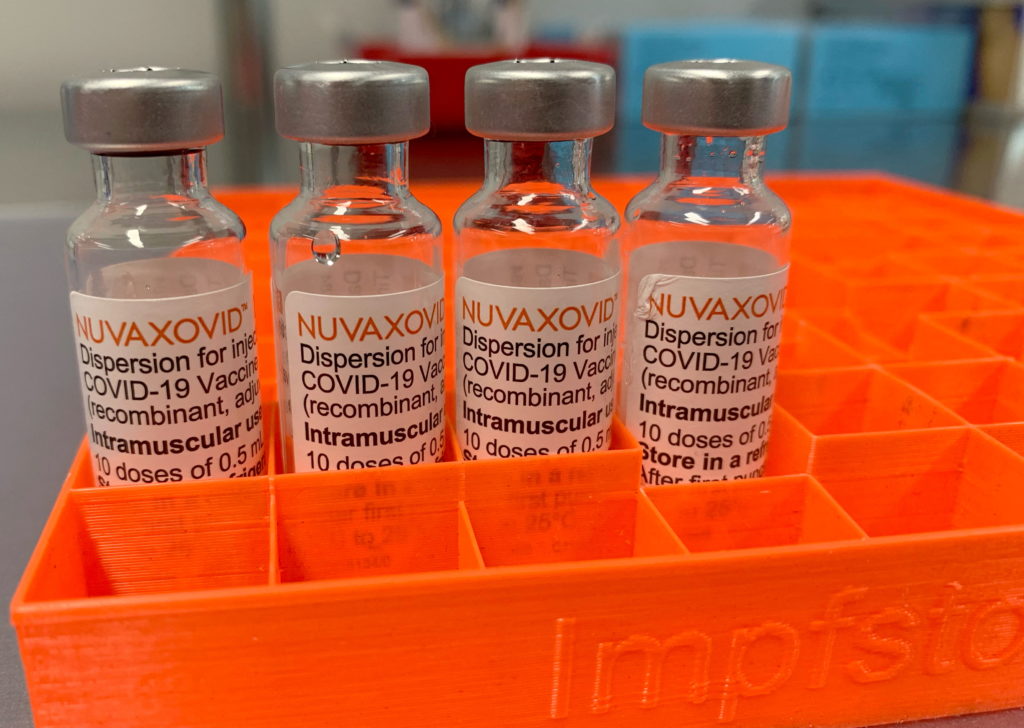

Novavax Covid 19 Vaccine Gets Fda Nod Strict Usage Guidelines Announced

May 20, 2025

Novavax Covid 19 Vaccine Gets Fda Nod Strict Usage Guidelines Announced

May 20, 2025

Latest Posts

-

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025 -

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025 -

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025 -

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025 -

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025